Tag: Options trading

Naked Call and Naked Put – Risky Option Trading Strategies

The naked call and naked put are option strategies where an investor sells options without having ownership in...

Box Spread (Long Box) – Option Trading Strategy

A box spread, also known as a long box, is an option strategy that combines buying a bull...

How to Deal with Noise and Distractions in the Market – Bob Lang

Bob Lang is the Founder and Chief Options Analyst at Explosive Options, as well as the President and...

Broken Wing Butterfly and Butterfly Spread – Option Trading Strategies

The broken wing butterfly and the butterfly spread are two different types of option trading strategies that involve...

Bear Call Spread and Bear Put Spread – Option Trading Strategies

The bear call spread and the bear put spread are option strategies used when an investor expects the...

What is the Options Clearing Corporation (OCC) – Everything you need to know

The Options Clearing Corporation is a clearing organization that acts as the issuer and guarantor for option and...

Interview with John Dobosz – Investment Expert and Writer

John Dobosz is the editor for two widely-read investment newsletters: Forbes Dividend Investor and Forbes Premium Income Report....

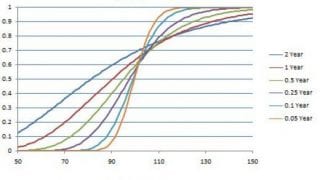

The Definition of the Greek Letter Theta – Options Trading

In relation to options, the Greek letter, Theta, represents how much an option’s price will decline due to...

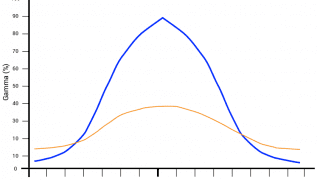

What does the Greek letter Gamma mean in Options Trading?

In regards to options, the Greek letter, Gamma, indicates how much the Delta will change given a $1...

What does the Greek Letter Delta mean – Options Trading

In terms of options, the Greek letter, Delta, is a theoretical estimate of how much an option’s price...