Paul Dykewicz

U.S. Economy Grew 3.2% in Q4 as Consumer Spending Picked up

The U.S. economy expanded at a 3.2 percent pace in the fourth quarter as Americans’ spending rose the most in three years, signaling clear improvement heading into 2014.

Stocks close at new 2014 lows as Fed tapers again

Stocks fell Wednesday as major benchmark indexes hit new 2014 closing lows after the Federal Reserve announced plans to cut its monthly bond purchases by an additional $10 billion a month.

Federal Reserve Cuts Stimulus to $65 Billion a Month

The U.S. Federal Reserve on Wednesday announced a further $10 billion cut to its monthly bond purchases as it stuck to a plan to wind down its monetary stimulus, despite recent turmoil in emerging markets.

Fed Expected to Announce Further $10 Billion Taper Today

Turmoil in emerging markets and a month of disappointing job growth at home are unlikely to deter the Federal Reserve from cutting its bond-buying stimulus on Wednesday, as Ben Bernanke presides at his last policy meeting as head of the U.S. central bank.

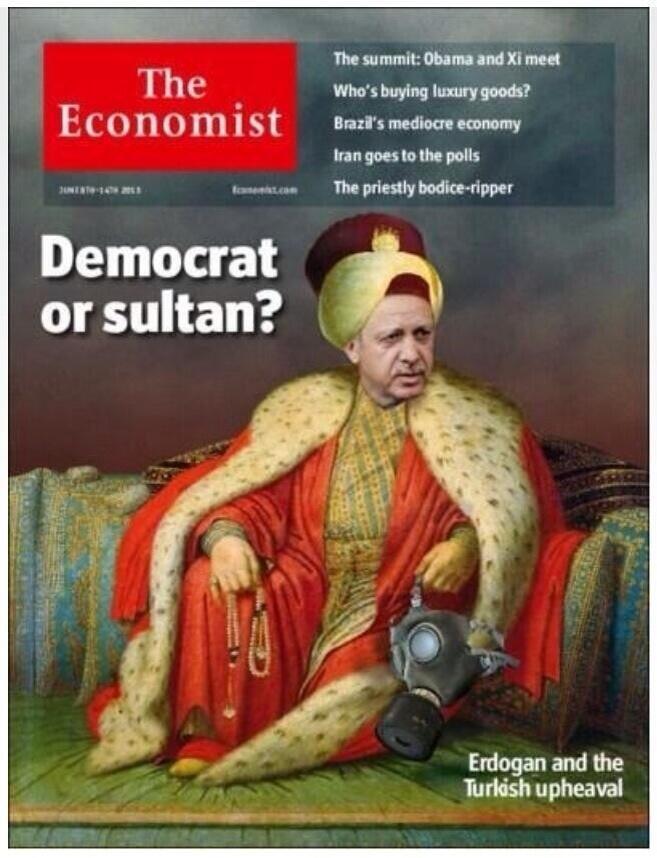

Turkey Rate Hike Fails to Halt Lira Bleeding as Stocks Slump

The lira reversed earlier gains after doubling its interest rates failed to assuage concern that Turkey’s economy will be hurt by a slowdown in China and a reduction in U.S. monetary stimulus.

U.S. Stocks Rise after Three-Day Sell-Off

U.S. stocks rose Tuesday, with the Standard & Poor’s 500 Index rebounding from its worst slump since June, fueled by earnings at companies from Pfizer Inc. to D.R. Horton Inc. topping estimates and consumer confidence rising.

![[Marriner S. Eccles Federal Reserve Board Building]](https://stage8.stockinvestor.com/wp-content/uploads/3363067053_e723e5dfa7_b.jpg)