Who knew that being a NERD had become so cool?

One of the most recent technological revolutions that has affected the way that humans spend their leisure time has been the development of video games.

Indeed, the gaming industry is a multi-billion dollar sector of the international economy, with its respective titans — Sony (NYSE:SNE), Nintendo Co., Ltd. (OTC:NTDOY) and Microsoft (NASDAQ:MSFT) — competing to produce the next big hit.

Gaming has even intersected with the world of competitive sports through the development of esports, which is a form of competition with multiple players participating in video games for an audience. Given the coronavirus epidemic, which is still raging around the globe, it’s no surprise esports shows no signs of abating (as we can witness through the new round of lockdowns in California and Europe). And, it is clear that the popularity of esports and gaming in general will only continue to grow.

An exchange-traded fund (ETF) called the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSE:NERD) was specifically constructed to enable investors to play this growing sector of the market. Thus, NERD tracks a tier-weighted list of global companies that are connected to esports and other digital gaming industries. The ETF is designed to provide investment results that closely correspond to the performance of the Roundhill BITKRAFT Esports Index.

Companies that appear in NERD’s portfolio include firms that are involved with video game publishing, development or streaming, the organization of video game tournaments, leagues or competitive teams or technology. The holdings are weighted by the degree to which the company in question is dedicated to gaming and sorted into categories like “Pure Play,” “Core” and “Non-Core.”

Some of this fund’s top holdings include Corsair Gaming, Inc. (NASDAQ:CRSR), Tencent Holdings Ltd. (OTCMKTS:TCTZF), Modern Times Group (STO:MTG-B), Activision Blizzard, Inc. (NASDAQ:ATVI), DouYu International (NASDAQ:DOYU), Razer, Inc. (OTCMKTS:RZZRY), Sea Ltd. (NYSE:SE) and HUYA, Inc. Class A (NYSE: HUYA).

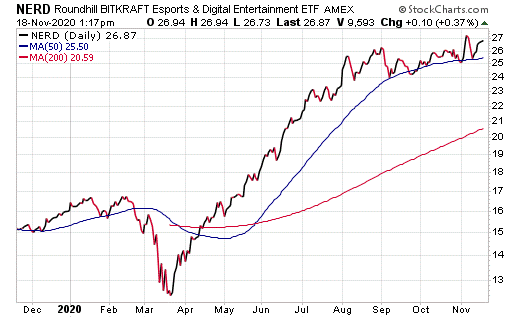

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Nov. 17, NERD has been up 4.69% over the past month and up 8.16% for the past three months. It is currently up 66.67% year to date. The fund has amassed $48.25 million in assets under management and has an expense ratio of 0.25%.

Chart courtesy of www.stockcharts.com

While NERD does provide an investor with a chance to tap into the world of gaming and esports, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.