A stock market crash rebound should give a hefty lift to six dividend-paying equities that not only provide income but potentially potent share price gains in the months ahead.

Dividend-seeking investors should profit from a stock market crash rebound that will be aided by recent passage of a $2.2 trillion federal government fiscal stimulus, Federal Reserve Bank actions to aid liquidity in the U.S. financial system and a slowdown in the growth rate of cases and deaths from the coronavirus pandemic. The following six dividend-paying stocks offer unique and strong positions in their respective sectors that should help to reward their shareholders amid a stock market crash rebound and protect them from the worst of any further market drops.

“Dividend payments are critical now because we face less certain capital gains in the coming years,” said Hilary Kramer, host of the weekly national radio program, “Millionaire Maker,” and leader of the Value Authority investment advisory service. “Dividends will be a more important part of total returns.”

Paul Dykewicz interviews money manager Hilary Kramer, whose advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Dividend Yields Will Be Chased During a Stock Market Crash Rebound

With the Fed likely to keep rates at 0% for a minimum of two years, investors will chase yields wherever they can be found, Kramer continued. She is recommending dividend-paying stocks that have strong track records and provide goods or services that should remain in demand despite the current coronavirus crisis that has shut down or curtailed activities at many businesses, particularly in the travel, hospitality and restaurant industries.

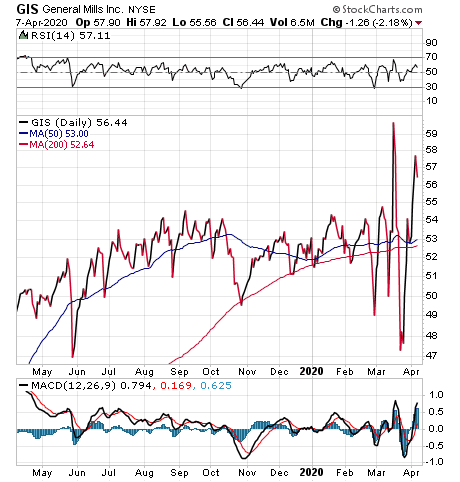

Kramer, who also leads the GameChangers advisory service and is the author of a new book called “GameChanger Investing,” has identified what she considers the “best dividend stocks” to buy and named General Mills (NYSE: GIS) as one of her top three. The food products company, dating back to its predecessor firm, has paid dividends annually for 120 years and offers one of the “safest” ways for income-focused investors to pursue yield, she added.

Minneapolis, Minnesota-based General Mills features some of America’s best-known brands, including Cheerios, Häagen-Dazs, Yoplait, Pillsbury and Betty Crocker, while offering no cyclical exposure. The company has been notching relatively consistent low-unit growth. Plus, the recent trend of consumers increasingly shopping from home during the coronavirus outbreak could help it top its May 2020 fiscal year estimate of $3.47, Kramer said.

In addition, the company’s current yield of 3.5% could be enhanced with potential dividend increases of 2%-3% per year, Kramer predicted. General Mills also has been boosting its product line in recent years to include healthy foods, such as Nature Valley granola bars and Cascadian Farm organic frozen vegetables and cereals, that offer further growth potential.

Chart courtesy of www.StockCharts.com

Another Dividend Payer Looks Ready for a Stock Market Crash Rebound

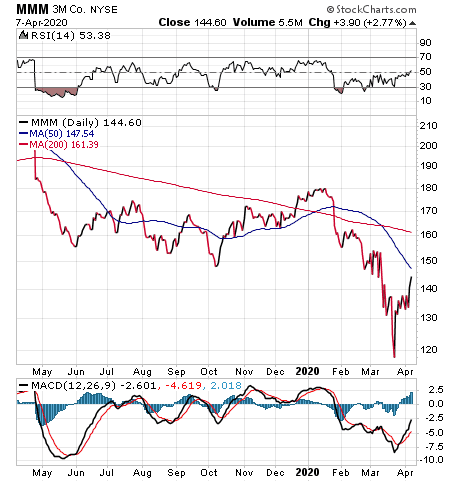

Another one of the “best dividend stocks” to buy is also a Minnesota-based company, 3M (NYSE:MMM), which is headquartered near St. Paul in Maplewood. 3M, a company that focuses on using science to provide a vast array of products, has paid dividends to its shareholders without interruption for more than 100 years and increased its annual dividend for 61 consecutive years.

3M’s four business groups feature Safety & Industrial, Transportation & Electronics, Health Care and Consumer products. The company has been in the news lately for its role in providing highly protective N95 masks, called respirators, that doctors, nurses and other health care workers urgently need to avoid contracting the coronavirus, also known as COVID-19.

President Trump announced at an April 6 White House press briefing on the coronavirus that 3M agreed to provide an additional 55.5 million respirators per month for the United States for three full months. Most of them will be the coveted N95 respirators that filter out 95% of all particulates and may help to avoid transmission of the coronavirus from patients to those who care for them.

Demand for N95 Respirator Masks Soars Amid Stock Market Crash Rebound

3M confirmed its agreement with the Trump administration involves importing another 166.5 million respirators from its overseas factories, including those in China, beyond the 35 million currently produced monthly at its U.S. plants. Company officials said 3M doubled its global output to nearly 100 million per month and expects to produce about 50 million respirators per month in the United States by June 2020.

The company’s global production of the N95 respirators is expected to nearly double from its current 1.1 billion output to almost 2 billion in the next 12 months. 3M also stated it has not hiked the prices it charges for its respirators during the current crisis.

“3M and the [Trump] administration worked together to ensure that this plan does not create further humanitarian implications for countries currently fighting the COVID-19 outbreak and committed to further collaborate to fight price gouging and counterfeiting,” the company announced.

3M Emerges as a Value Play to Profit from a Stock Market Rebound

“The company’s strong franchises and solid financial position should continue to allow it to be a steady performer this year,” Kramer told me. “Let me also say that while the company’s mask business has gotten the company both favorable and unfavorable attention in recent weeks, I only expect this business to be modestly additive to earnings this year. Furthermore, I anticipate that any unfavorable attention the company is currently getting will fade.”

3M’s pact to expand production to provide needed respirators to health care professionals during the coronavirus crisis now is drawing praise from President Trump, rather than criticism. President Trump has advocated staunchly for the Federal Emergency Management Agency (FEMA), other U.S. government agencies and U.S. hospitals to receive the respirators needed to meet domestic demand.

Chart courtesy of www.StockCharts.com

3M has long been regarded as one of the most dependable of industrial stocks, but it has incurred “weakness” in its business electronics unit in recent years, Kramer said. The current economic downturn also will present significant challenges, she added.

“However, the company has a strong balance sheet, and free cash flow is 100% of net income,” Kramer continued. “Therefore, I believe the very attractive 4.1% dividend yield is safe, with the company retaining solid profitability through the downturn. Longer term, relatively new CEO Mike Roman will initiate actions to resume the company’s growth.”

3M’s 2019 global sales reached $32.1 billion, with net income of $4.6 billion, research and development spending of $1.9 billion and cash dividend payments of $5.76 per share.

Genuine Parts Also May Motor Ahead Amid Stock Market Crash Rebound

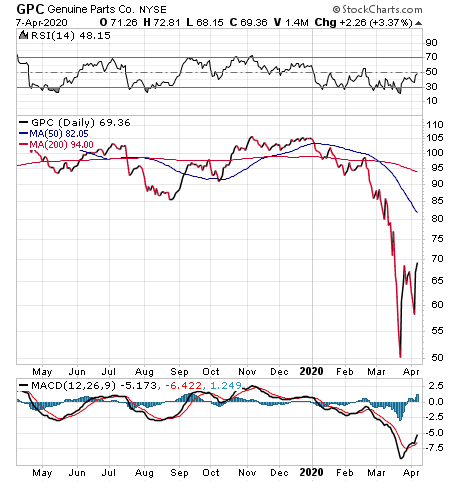

Genuine Parts Company (NYSE:GPC), a distributor of automotive replacement parts in the United States, Canada, Mexico, Australia, New Zealand, France, the United Kingdom, Germany, Poland, the Netherlands and Belgium, has been “very hard hit” by the coronavirus, and the shutdown of part of the economy has led to “much less driving,” Kramer said. The crisis is expected to have a significant impact on the company’s earnings this year, but the 5.1% yield is simply too good to resist, she added.

“The company should remain profitable through the downturn and the dividend should be safe,” Kramer continued. “Once there are signs the growth of the virus is slowing and we are closer to returning to normal economic activity, the stock should soar.”

Genuine Parts, which also distributes industrial replacement parts and business products, announced after markets closed on April 6 that it was withdrawing guidance for the year due to the coronavirus. The company also indicated that it was suspending share buybacks, expanding the $100 million cost savings program that it announced last year and working with banks to stay within its loan covenants.

“On the bright side, the company said that it would pay its regular quarterly dividend of $0.70 a share on July 1 for shareholders of record on June 5,” Kramer said. “The company will have new guidance for the year when it reports earnings on May 6.”

Chart courtesy of www.StockCharts.com

Stock Market Crash Rebound Prospect Has Hiked Its Dividend Payout 63 Straight Years

Genuine Parts has paid dividends since 1948, offers a current yield of 5.42% and 2020 marks the 64th successive year it has increased its payout, according to www.dividendinvestor.com. At the company’s February 17, 2020 board meeting, its directors voted to boost the cash dividend payable by 4% to an annual rate of $3.16 per share, compared with the previous dividend of $3.05 per share.

“I continue to believe that the company has the financial power to withstand the crisis and should be able to come close to earning the $5.69 a share it earned a year ago once again in 2022,” Kramer said.

The growing uncertainties due to COVID-19 have rapidly evolved and “significantly affected” market conditions, the company announced. COVID-19 is expected to impact the company’s results and prevent it from achieving its previously stated full-year 2020 guidance.

Cash Conservation, $100 Million in Savings May Aid Stock Market Crash Rebound

Genuine Parts officials said the company maintains a strong balance sheet and is conserving cash by reducing capital expenditures and mergers and acquisitions. In addition, Genuine Parts expanded its original $100 million cost savings plan announced in October 2019 to include a variety of additional measures to trim labor and other costs.

While the company’s current liquidity remains strong, with approximately $1.0 billion in cash and unused credit as of March 31, 2020, it is collaborating with its banking and other partners for alternative forms of financing to stay in continued compliance with its debt covenants. Through these actions and its ongoing working capital initiatives, Genuine Parts has the liquidity to operate through the current uncertain times and continue to pay its dividend, the company announced.

Each of the company’s automotive, industrial and business products segments have been classified as “essential” businesses and its operations largely remain open to serve its customers through the pandemic, with the exception of France and New Zealand due to “preemptive government mandates,” Genuine Parts announced. Its supply chain partners have been supportive and continue to help ensure that customer service levels are maintained, the company added.

Safe Dividend Payers Show Another Path to a Stock Market Crash Rebound

Seasoned Wall Street trader Bryan Perry, who heads the Cash Machine advisory service, tracks high-yield stocks closely and compiled his own three favorites. He also chose a medical stock, but one that operates as a real estate investment trust (REIT).

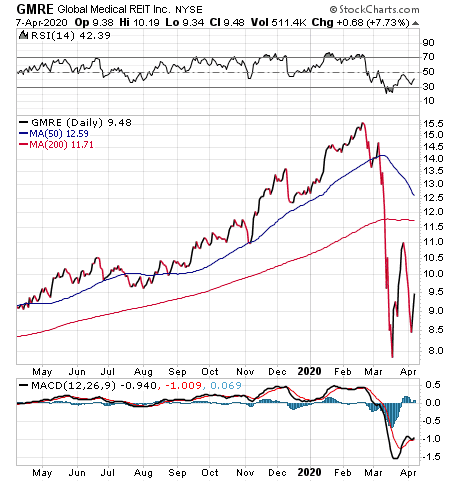

Global Medical REIT (NYSE:GMRE) selectively acquires licensed, all-purpose health care facilities and leases them to clinical operators under long-term, triple-net leases in which the tenant pays all the expenses of a property including real estate taxes, building insurance and maintenance. The company is seeking to tap into an 5.4% annual increase in U.S. health care spending that is projected for 2019-28 by the U.S. Department of Health and Human Services. The total is expected to reach $6.2 trillion by 2028.

National health expenditures are forecast to grow an average of 1.1 percentage points faster than gross domestic product (GDP) per year from 2019-28. In addition, health care’s share of the economy is pegged to rise from 17.7% in 2018 to 19.7% in 2028.

One reason is that outpatient surgeries are surging. The worldwide market for Ambulatory Surgery Center procedures is expected to grow at a cumulative annual growth rate (CAGR) of roughly 4.9% for the next five years to reach $103,700 million in 2024, compared to $77,800 million in 2019.

Technology Advances Position REIT to Rise During Stock Market Crash Rebound

Technological advances are spurring physician groups to break away from hospitals to form their own outpatient solutions, said Perry, who also leads the Hi-Tech Trader advisory service. Global Medical’s diversified portfolio of properties is comprised mainly of off-campus Medical Office Buildings, Specialty Hospitals, Inpatient Rehabilitation Facilities and Ambulatory Surgery Centers.

Those changing health care trends are driving new REIT structures, as reflected by Global Medical, whose acquisition strategy aligns with America’s aging population and decentralized health care services, Perry said. Global Medical operates 101 facilities with a 99.8% occupancy rate from 41 tenants that occupy 2.8 million square feet of space and average 8.8 years left on the lease terms, he added.

Paul Dykewicz interviews Bryan Perry.

Global Medical completed its initial public offering (IPO) in mid-2016 at $10 per share and traded as high as $16 per share prior to the coronavirus crisis. An entry price under $13 would be an excellent value for this recession-resistant REIT, Perry opined.

The company’s 2019 revenues rose 32.7% year-over-year to $70.5 million, spurred by acquisitions. Global Medical’s quarterly dividend of $0.20, equaling an annualized rate of $0.80 per share, gives it a current dividend yield of 8.4%.

Chart courtesy of www.StockCharts.com

Another REIT Should Bounce Back with Stock Market Crash Rebound

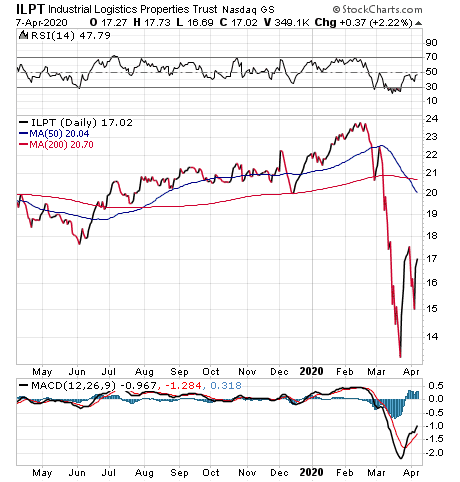

REITS focused on industrial logistics are showing strong growth from the expansion of ecommerce distribution, Perry said. Consumers and businesses are shifting their shopping to online platforms where “just-in-time” delivery of goods is a key part of today’s strategies, he added.

Perry estimated 15 publicly traded REITs offer industrial logistics, but he identified Industrial Logistics Properties Trust (NASDAQ:ILPT) as the “purest play” in the group. It offers a current dividend yield of 7.8%, and owns 300 properties, occupying 42.8 million square feet.

ILPT owns vast land holdings in Hawaii on the island of Oahu, between downtown Honolulu and the airport. The company leases the land and buildings that account for roughly 60.8% of total leased space where long-term rent increases have a history of recession resistance. Mainland properties are in 29 states, with Amazon.com (NASDAQ:AMZN) as its largest tenant.

Chart courtesy of www.StockCharts.com

Normalized funds from operations (FFO), for the quarter ended December 31, 2019, hit $0.46 per share on a 47.8% year-over-year increase in revenues to $62.2 million. At the end of the third quarter, 99.5% of ILPT’s total rentable square feet was leased to provide stable income in a domestic sector that is seeing 17.6% annual growth. The stock pays an annual dividend of $1.32 to provide a current dividend yield of 7.9%.

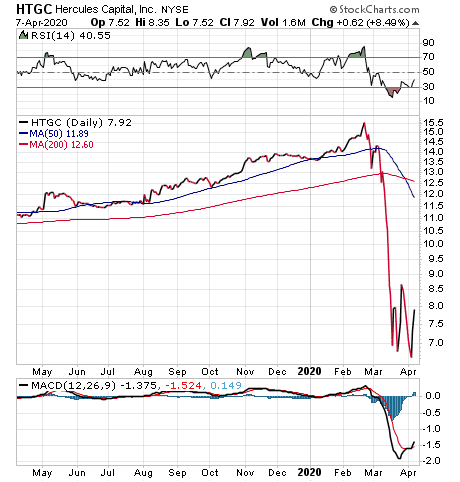

Hercules Also May Participate in a Stock Market Crash Rebound

Hercules Technology Growth Capital (NYSE:HTGC) is a specialty finance company based in Palo Alto, California, that provides debt and equity financing to venture capital and private equity-backed technology and life science companies. Founded in 2003, the company is guided by a team of 13 managing directors and principals that collectively have more then 280 years of venture capital and specialty technology investing experience.

Chart courtesy of www.StockCharts.com

The strong rebound in the technology sector during the past two years buoyed HTGC’s financial results until the recent coronavirus-caused pullback, Perry said.

As a business development company (BDC), HTGC is required to pay out 90% of its net income to shareholders. HTGC pays out a $1.28 annual dividend to deliver a current yield of 17.55%.

The coronavirus crisis has led to government leaders in countries around the world to order people to stay indoors with limited exceptions as the number of cases and deaths totaled 431,706 and 82,080, respectively, as of April 7. The number of cases jumped 66.7% in the past week, while deaths soared 94.7%. In the United States, the growth rate reached 112.4% in cases to hit 400,412, with deaths jumping 230.5% to total 12,854, on April 7. Even though far more people died in the past week of coronavirus in America compared to the entire prior life of the infection, the growth rate fell almost in half from 401.8% the previous week.

With a stock market crash rebound taking shape, investors who have cash available may want to consider investing in these six companies that consistently pay dividends and are likely to benefit from rising share prices, too. In a volatile stock market, dividend-paying stocks offer a bit of insulation from the worst of any plunges since they tend to fall less than non-dividend payers.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.