Stock market crash protection is offered by a unique bond investment and real estate investment trusts (REITs) for investors seeking to avoid correlation with major equity indexes.

These investments feature a bond that offers an 8.5 percent annual return for a seven-year commitment, as well as two REITs that focus on hotel and apartment properties, respectively. With the stock market in the midst of its longest and biggest bull market ever, it is understandable that investors may wonder and worry when the climb will end, especially with the spread of the deadly coronavirus to 36 other countries around the world from its origin in Wuhan, China.

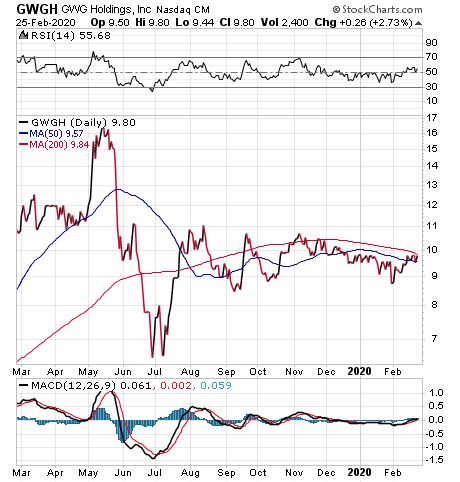

GWG Holdings, Inc. (Nasdaq: GWGH), a Minneapolis-based financial services holding company, owns a large, actuarially diverse portfolio of life insurance policies from “highly rated life insurance companies” through its subsidiary GWG Life. The holding company also has a strategic investment in the Beneficient Company Group, L.P. (BEN) which helps to provide liquidity to people who have life insurance policies and are willing to sell the benefits at a discount to obtain near- and long-term income during their lives.

Unique Bond Helps Provide Stock Market Crash Protection

GWG’s investment strategy is designed to produce income and create value from investments in life insurance and other diversified alternative assets. Roughly 95.71% of the policies owned by GWG Life are backed by insurance companies that S&P rates as investment grade. GWG had amassed 1,190 life insurance policies totaling $2.1 billion in life insurance benefits at the end of September 2019.

The average age of the insured reached 82, while $909 million, or more than 44 percent of the life insurance benefits, are for policyholders who were age 85 and up at the end of September 2019. The top five insurance companies represented in the policies owned by GWG are well-known names such as John Hancock, Lincoln National, AXA Equitable, Transamerica and Metropolitan Life.

GWG management described its portfolio as “seasoning” by earning “more consistent benefits” through the settlement of its life insurance policies as the insured people die. At the end of September 2019, $321 million of its pool of life insurance policies covered insureds past age 90.

Money Manager Addresses Insurer’s Stock Market Crash Protection

“The ability to lock in 8.5 percent annualized income over the next seven years is appealing if you’re looking for a place to park some defensive capital,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service. “In a world where Treasury debt of the same term pays 7 percentage points less and corporate bonds are only a little more attractive, the enhanced income benefit is clear.”

A key question is how GWG can pay that much interest to investors. The life insurance portfolio is the answer, since GWG buys policies from people who would rather spend the money while they’re alive and let the company cash the death benefit when the original beneficiaries die, Kramer explained.

It is an “extremely intriguing” business model, if the transaction is priced right, Kramer continued.

“I would treat these bonds as an enhanced CD,” said Kramer, who also leads the Value Authority advisory service. “Lock in that piece of your portfolio and earn 8.5 percent. The S&P 500 pays a little better in a typical year, but it’s volatile and a lot of investors are feeling a little uneasy these days. If that’s you, get off the rollercoaster by pivoting into income-generating assets. Very few mature REITs can compete here for pure yield. My favorite in the apartment space, Equity Residential Trust (EQR), doesn’t even pay 3 percent.”

The other piece of the GWG portfolio is interesting as well, since private equity can pay huge returns over the long term for investors to get in early and commit their money for several years, Kramer said. Once again, investors must be able to keep their money in the bond investment for the full term between now and 2027, she added.

Paul Dykewicz interviews Wall Street money manager Hilary Kramer, whose advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

GWG Management Discusses Stock Market Crash Protection Product

In GWG’s November 21, 2019, third-quarter financial results call, Murray Holland, its president and chief executive officer, said, “The business of GWG is to provide liquidity for alternative assets owned by individuals who need liquidity for life events and investments.”

GWG has a diversified portfolio of investments, with about 52 percent in life insurance assets, 42% comprising investments in Beneficient and about 5.5 percent in cash. That totals consolidated assets of $1.5 billion, with shareholders’ equity just above $200 million.

The Beneficient asset investment strategy gives diversification to GWG and access to its partners’ professionally managed funds, including private equity, credit funds, real estate funds and hedge funds. The largest portions are hedge funds and private equity funds, real estate investments, private credit, infrastructure and natural resources.

These funds are the type of investments that larger financial institutions, such as pension funds, endowments and foundations, have had access to for more than the past 30 years. Individuals now can tap them for liquidity through BEN and GWG to meet needs created by life changes, such as divorce, disability and business matters.

During third-quarter 2019, GWG’s maturities rose from 2018. GWG restarted its L Bonds sales program in early August of 2019 and it hired five new sales executives with experience in alternative asset investments, Holland said.

During the past five years at GWG, there has been a significant decline in yields on these policies, Holland continued. The yield is critical, since GWG is financing its business with debt instruments that have yield of their own, he added.

Risk-Averse Investors Should Beware of Uncertainties with GWG

GWG now is included in the Russell 2000 Index of small-cap stocks. But any risk-averse investors who are unable to withstand a significant loss of their money may want to look for opportunities other than the bonds.

GWG is trying to establish a niche business that requires insured life insurance policyholders to die before investors can benefit from the full payout of the policy benefits. So far, GWG is racking up financial losses while it waits for elderly life insurance policyholders to die to collect the full benefit of their policies.

Investors also should keep in mind that insurance companies such as GWG that sell investment products cannot offer the 100 percent protection bank depositors receive from the Federal Deposit Insurance Corporation (FDIC), up to $250,000 for each person per bank.

Chart courtesy of www.StockCharts.com

REITs Provide Alternative Way to Gain Stock Market Crash Protection

While unfamiliar with GWG Holdings and its business, Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said he does follow real estate investment trusts closely.

“Every investor who is in or planning for retirement should have diversified REITs in his or her portfolio,” said Carlson, who also who leads the Retirement Watch advisory service. “They’ve almost always been in Retirement Watch portfolios and increase or decrease the holdings as market conditions warrant. REITs have a low correlation with stock indexes, meaning they don’t move automatically up or down with the indexes the way most stocks do.”

However, REITs are equity investments, Carlson continued. As a result, REITs often rise when the stock indexes decline, but REITs are not completely uncorrelated with the stock indexes, he added.

“In the tech stock crash of the early 2000s, REITs increased in value,” Carlson said. “But in the financial crisis crash of 2008, REITs declined significantly.”

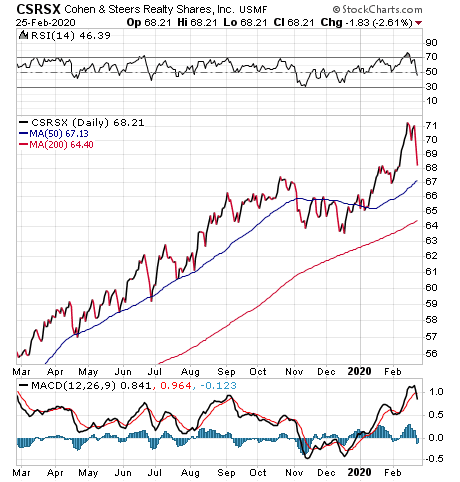

REITs Beat Major Stock Indexes and Offer Stock Market Crash Protection

REITs have outperformed the major stock indexes for a long time, Carlson told me.

“I usually recommend Cohen & Steers Realty Shares (CSRSX) as a core investment,” Carlson said. “It has outperformed the S&P 500 over 15 years and over some shorter periods.”

Chart courtesy of www.StockCharts.com

Now is a “great time” to own REITs, Carlson said. They lagged in 2015-2018 because investors were attracted by stock indexes, but REITs are coming back and selling at good values, he added.

Plus, the current economic environment is “very good” for REITs, Carlson continued. With low growth, mild inflation and modest and falling interest rates, speculators will be deterred from “overbuilding,” added Carlson.

Diversified REITs Give Stock Market Crash Protection to Investors

A growing economy helps the commercial real estate that REITs own. To reduce risk, Carlson said he likes to buy a diversified portfolio of REITs or a fund that invests in a number of REIT sectors.

“Focusing on one or two sectors is risky,” Carlson said. “Hotels, for example, rise and fall with prospects for economic growth. Apartments are more stable but can be prone to overbuilding.”

For investors seeking heightened returns, Cohen & Steers also has closed-end funds that use leverage to increase yield and potential profitability, Carlson said. These closed-end funds often sell at a discount, so investors can buy the REITs at less than their market price, Carlson continued.

Bob Carlson answers questions from Paul Dykewicz during an interview.

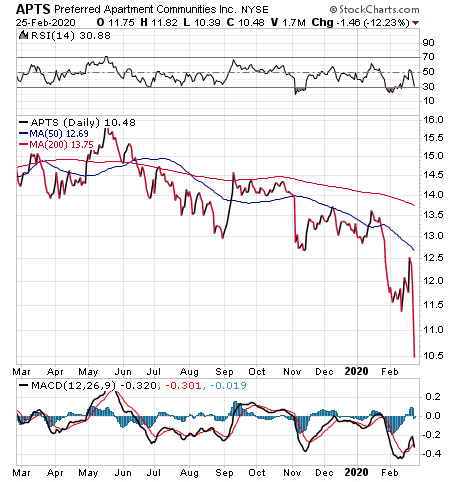

Preferred Stock Offering Provides Stock Market Crash Protection

Atlanta-based Preferred Capital Securities, LLC (NYSE:APTS), is the deal manager for PAC, which offers redeemable preferred stock based on the ownership and operation of multifamily properties and, to a lesser extent, student housing and other real estate. A secondary strategy is to provide real estate loan investments to multifamily communities, student housing properties, grocery-anchored shopping centers and office buildings.

Specifically, Preferred Capital Securities has a redeemable preferred stock offering that pays an escalating contractual dividend rate starting at 6.1 percent that increases by 0.1 percent annually until reaching a cap of 7.1 percent. The dividends are paid monthly.

Investors in the preferred stock retain access to their capital, aside from a 90-day dividend recapture provision in year 1.

Chart courtesy of www.StockCharts.com

PAC also has another redeemable preferred offering that provides a 6 percent annualized dividend intended to be paid monthly. It offers liquidity from day one to investors, subject to a three-year declining redemption fee of 13 percent, 10 percent and 5 percent, respectively.

Moody Also Offers a REIT Aimed at Giving Stock Market Crash Protection

Moody National REIT II, Inc. also is available to investors interested in exposure to hotel properties as an alternative to traditional equities. Investors should plan to keep their money in the REIT for three to six years from completion of the initial public offering. Those interested in participating also should have a net worth of at least $250,000 or a gross income of no less than $70,000 and a net income of a minimum of $70,000.

The REIT’s investment objective is to select the asset class with the highest propensity to increase net operating income in the shortest period. So far, that asset class continues to be hotels.

Another Stock Market Crash Protection Strategy Uses Dividend-Paying Stocks

Dr. Mark Skousen, who heads the Forecasts & Strategies investment service that is celebrating its 40th anniversary this year, cautions investors that the Dow has fallen during the past week due to the spread of the coronavirus outside China. The virus is proving difficult to contain and also has shut down supply chains that will hurt economic growth and businesses.

For that reason, he favors recommending stocks and funds in his Forecasts & Strategies service that pay dividends. For investors who want to pursue growth and buy related call options in pursuit of even bigger returns, Dr. Skousen also offers his Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert trading services.

Whether the kind of catastrophic event or series of calamities that typically cause a stock market crash could occur from the ongoing spread of the coronavirus, which has caused roughly 3,000 deaths and 80,000-plus infections as of Feb. 25, remains an open question. Public health officials in China at the epicenter of the outbreak warn that the threat could be 20 times more deadly than the flu virus. Even though the pace of the infection’s spread could ease in the summer months as the weather warms and people increase their time outdoors, the coronavirus could cause a second surge of infections in the fall along with the traditional flu when temperatures cool.

The bond and REIT investments featured in this write-up offer alternatives to traditional stocks and funds. When the market drops amid the longest and biggest bull run in history, it is wise for investors to know about ways to reduce their risk.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.

![[happy investor up arrows]](https://stage8.stockinvestor.com/wp-content/uploads/shutterstock_124509472.jpg)