The month of August closed out on a three-day uptick for the major averages, boosted by a rising narrative that the U.S. consumer is feeling pretty good about the present situation.

The Conference Board’s Senior Director of Economic Indicators Lynn Franco stated, “Consumers’ assessment of current conditions improved further, and the Present Situation Index is now at its highest level in nearly 19 years (since November 2000). While other parts of the economy that depend on export growth may show some weakening, consumers have remained confident and willing to spend.”

Why? Consumers’ appraisal of the job market is more favorable. According to the Conference Board, “Those saying jobs are ‘plentiful’ increased from 45.6 percent to 51.2 percent, while those claiming jobs are ‘hard to get’ declined from 12.5 percent to 11.8 percent.”

The United States is a consumer-driven economy that accounts for 70 percent of gross domestic product (GDP) growth. The second estimate for second-quarter 2019 GDP showed a downward revision to 2.0 percent annualized growth from 2.1 percent annualized growth reported in the advance estimate, according to Briefing.com. Despite the adjustment, the numbers show that the trade war hasn’t materially impacted spending trends.

“The key takeaway from the report is that consumer spending growth was revised up to 4.7% from 4.3%, which was the strongest growth since the fourth quarter of 2014,” according to Briefing.com. “Granted it’s a backward-looking data point, yet it offers a nice reminder that the U.S. consumer, supported by a tight labor market, has remained in good shape.”

Reduced borrowing costs within a $21+ trillion economy is acting as a huge lever and I expect the Fed to keep the consumer jazzed with rate cut on Sept. 18.

Who would have wagered a lunch at a Wall Street food truck that the big-box retailers would be the hottest sector during August with trade tensions boiling over? Shares of Target (NYSE:TGT), Walmart (NYSE:WMT), Home Depot (NYSE:HD), Lowe’s (NYSE:LOW) and Costco (NASDAQ:COST) soared this past month. As a side note, Costco opened its first store in Shanghai and had the local police limit the number of customers occupying the store at any given time to 2,000! I guess Costco consumers in Shanghai didn’t get the memo that there’s a trade war breaking the Chinese economy.

The trade war with China reached a fever pitch on Friday, Aug. 13, after President Trump tweeted that he would retaliate against China’s new tariffs on U.S. imports by raising tariffs on Chinese imports. The talk sent the Dow plunging by over 700 points.

But it’s not just the robust U.S. consumer that alters the negative investor sentiment, it’s the simple fact that money goes where it is best served. Hedge fund Hayman Capital’s manager Kyle Bass, whom I view as sharp and transparent, stated in a CNBC interview on Aug. 20, “We’re the only country that has an integer in front of our bond yields. We have 90% of the world’s investment-grade debt. We actually have rule of law and we have a decent economy. All the money is going to come here.”

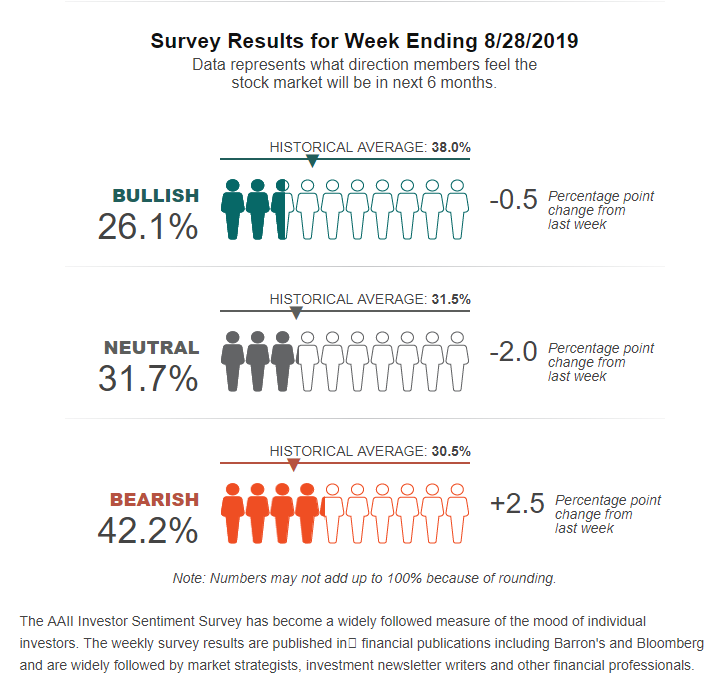

All this good news regarding an upbeat consumer comes at a time when investor sentiment is in the tank. The latest American Association of Individual Investors (AAII) survey has bullish sentiment down at 26.1% and well off its mid-30% historical level that is considered neutral. The good news about this survey is that it happens to be one of the most accurate contra-indicators that signal market tops and bottoms. If past is prologue, a low bullish reading of 26.1% is a green light to add equity risk to portfolios.

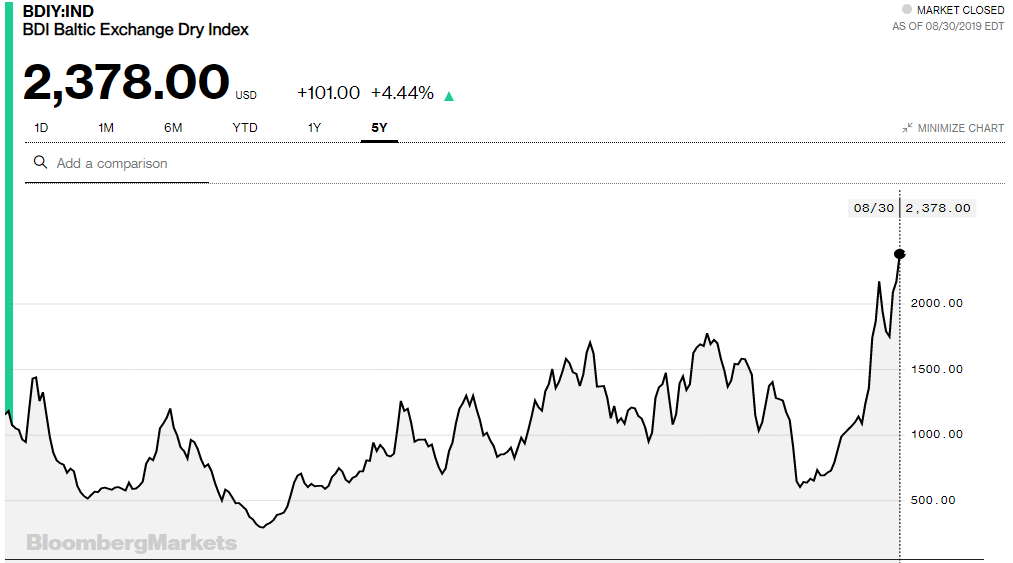

Is the Baltic Dry Index Signaling a Global Economic Recovery?

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal, copper, cement and iron ore. The Baltic Exchange calculates the index by assessing multiple shipping rates across more than 20 routes for each of the BDI component vessels. Analyzing multiple geographic shipping paths for each index gives depth to the index’s composite measurement. Members contact dry bulk shippers worldwide to gather their prices and they then calculate an average. The Baltic Exchange issues the BDI daily.

Because dry bulk primarily consists of materials that function as raw material inputs to the production of intermediate or finished goods, such as concrete, electricity, steel and food, the index is also seen as an efficient economic indicator of future economic growth and production. The BDI is considered by some people as a leading economic indicator because it predicts future economic activity.

Unlike stock and bond markets, the BDI “is totally devoid of speculative content,” said Howard Simons, an economist and columnist at TheStreet.com. “People don’t book freighters unless they have cargo to move. News flash: this past week the Baltic Dry Index traded to a fresh nine-year high capped by a torrid seven-day straight up rally.”

I’m not making a call on a global economic rebound, but am simply bringing to light an identifier that got my attention this past week. Since the great majority of economic data are looking backward, it just makes sense to pay attention to the BDI Index for clues that fully defy the current and widely-held bearish narrative regarding global growth. It is food for thought, but also quite possibly a healthy tea leaf amid a very crowded field of thorny prognostications.

Join me at The MoneyShow Philadelphia!

The MoneyShow is heading to Philadelphia for the first time ever and I’m excited to join some of the country’s smartest professional investors and traders at this complimentary, three-day event, Sept. 26-28.

I will be analyzing sectors and trends, as well as sharing with you time-tested strategies for profiting in the markets.

I also will be joined by investing experts such as Hilary Kramer, Bob Carlson and Dr. Mark Skousen in discussing stocks, exchange-traded funds (ETFs), income investing, real estate investment trusts (REITs), commodities, trading strategies and much more!

To register, click here or call 1-800-226-0323 and be sure to mention my priority code of 048301 to receive complimentary admission.