After a steady decline in the second half of 2018 and a steeper drop towards a 52-week low driven by the overall market pullback in late December, Quest Diagnostics Incorporated (NYSE:DGX) saw its share price reverse direction and regain some of its losses during the current uptrend in 2019.

The current share price already recovered 30% of its losses from its 52-week high and nearly 60% of its losses from one year ago. While the recent share price pullback delivered losses to existing shareholders over the last two years, the long-term rising share price has risen relatively steadily over the past five years and the drop in 2018 brought the price just slightly below its five-year uptrend.

The share price decline that began in late July 2018 drove the 50-day moving average (MA) below the 200-day MA by the end of October. The 50-day MA continued to drop until the end of February 2019. However, since the beginning of March, the rising share price provided some upward pressure and the 50-day MA has been rising over the past month. While still approximately 7% below the 200-day MA, the share price has been closing the gap and has been trading above the 50-day MA since March 12.

Financial Results

Quest Diagnostics reported on February 14, 2019, the financial results for its fourth-quarter and full-year 2018. Fourth-quarter revenues of $1.84 billion were down 1.4% compared to the same period last year. Because of tax benefits recorded as a result of the Tax Cuts and Jobs Act (TCJA) in the fourth quarter of 2017, the current quarter’s diluted Earnings per Share (EPS) of $0.92 were nearly 50% lower than the same quarter last year. However, adjusted earnings trailed last year’s fourth-quarter figures by merely 2.9%.

Driven by positive performances in early quarters of 2018, full-year performance delivered positive results. Full-year revenues rose 1.7% over the previous year to $7.53 billion. While down year over year like the fourth quarter figures, full-year diluted EPS of $5.29 was just 3.8% lower than 2017, which included the tax benefit in the fourth quarter. However, on an adjusted basis, the diluted EPS of $6.31 for the full year was 16.7% higher than previous year.

For full-year 2019, Quest Diagnostics projects diluted EPS of at least $5.16 and also expects adjusted diluted EPS excluding amortization expense to exceed $6.40. “Quest is well positioned once again in 2019 to deliver on our commitment to grow revenues and earnings, as our in-network status now extends to approximately 90% of commercially insured lives in the U.S.,” said Steve Rusckowski, Chairman, CEO and President. “Our guidance for 2019 reflects significant reimbursement pressure offset by strong volume growth and continued execution of our Invigorate program. I am pleased to report our volumes for the year are off to a good start.”

Quest Diagnostics Incorporated (NYSE:DGX)

Headquartered in Secaucus, New Jersey, and founded in 1967, Quest Diagnostics Incorporated provides diagnostic testing, information and services primarily under the Quest Diagnostics brand. Also, the company delivers its services under additional brands, such as AmeriPath, Dermpath Diagnostics, Athena Diagnostics, ExamOne and Quanum. Currently, Quest Diagnostics operates a network of more than 2,200 laboratories, as well as patient service and call centers. Additionally, Quest Diagnostics directly employs phlebotomists in physician offices, mobile paramedics, nurses and other health and wellness professionals, which offers approximately 6,600 customer access points. In addition to its U.S. facilities and distributing its testing products in 130 countries, Quest Diagnostics operates clinical laboratory facilities in Brazil, India, Ireland, Mexico and Puerto Rico. A component of the S&P 500, Quest Diagnostics serves approximately half of the physicians and hospitals in the United States and provides services to nearly 30% of American adults each year. Quest Diagnostics provides its services through its workforce of about 46,000 employees — including a medical and scientific staff of more than 600 M.D.s and Ph.D.s — and a logistics network that includes nearly 4,000 courier vehicles and 25 aircraft.

Share Price

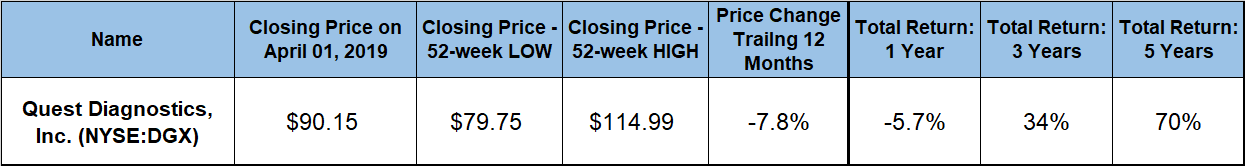

After a small pullback in 2017, the share price entered the trailing 12 months on a steady uptrend. Over the subsequent three months, the share price gained more than 17% and reached peak levels by July 2018. This uptrend culminated with the all-time high closing price of $114.99 on July 18, 2018.

However, following tepid financial results in the second quarter, the share price reversed direction and declined in the third quarter. This downtrend was amplified by the overall market correction in December 2018. Quest Diagnostics’ share price declined 30% to reach its 52-week low of $79.75 on December 24, 2018.

Since another direction reversal in late December 2018, the share price advanced to close on April 1, 2019, at $90.15, which was 7.8% lower than one year earlier. However, the April 1 closing price was also 13% above the December low and nearly 60% higher than it was five years earlier.

Quest Diagnostics rewarded its shareholders with a 2.3% dividend for the year which offset some of the share price losses to cut the total loss for the year to 5.7%. However, long-term shareholders enjoyed a 34% total return over the past three years and a total return of 70% over the past five years.

The company has boosted its annual dividend 430% over the past eight years, which is equivalent to an average annual growth rate of more than 23% per year. Quest Diagnostics will distribute its next quarterly dividend of $0.53 per share on April 22, 2019, to all shareholders of record prior to the company’s April 5 ex-dividend date.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.