It seems that no matter which financial media source you consult, all the news regarding emerging markets center around issues in the Chinese economy.

There is, of course, good reasons for this. ABC News reported that an important real estate developer in China — Country Garden — failed to meet a scheduled debt payment, causing a cascading effect on global markets. Everywhere one looked, one saw the same question: How shaky is the Chinese economy, where real estate is a primary driver of the economic boom there — albeit one built on a great deal of debt?

After all, such a problem in the Chinese real estate market is not new. In 2021, financial problems and an eventual default by Evergrande caused a slide in global markets that was only arrested when Chinese officials said the crisis was contained and credit markets would continue as normal. This new default in the Chinese real estate sector has proved that there are problems in the Chinese economy — problems that will likely remain present into the near future.

Other emerging markets, according to the Globe and Mail, are doing much better than China. For instance, when we look at the MSCI Emerging Markets Index (which includes China), we see a rise of 11.4% by the end of July. When China is removed from the index, and we look at the MSCI EM Ex-China Index, we see a rise of 14.6% over the same time.

As a result, some emerging-market investors are turning away from China and toward Taiwan and South Korea — two countries that are also benefitting from the artificial intelligence (AI) wave that is sweeping the American tech sector. Still others have turned to Europe, especially Greece, largely due to the recent electoral victory of a pro-business government.

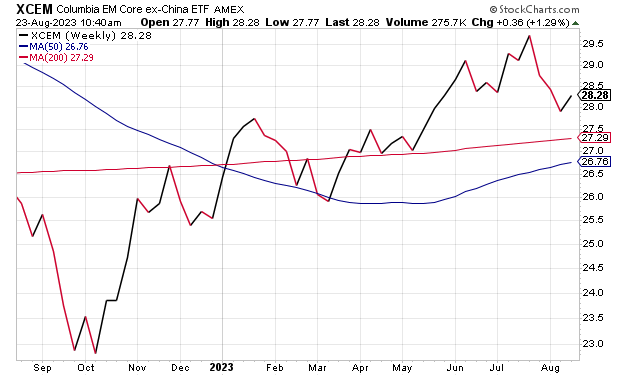

For investors who want to enter the world of emerging markets but who want to steer clear of the Chinese economy for the time being, the Columbia EM Core ex-China ETF (NYSEARCA: XCEM) might appeal to them. This fund tracks an index of emerging market companies that are not in either mainland China or Hong Kong. The portfolio is built through a market-cap-weighting strategy that selects the largest 700 companies by market capitalization.

Top holdings in this portfolio include Taiwan Semiconductor Manufacturing Co. Ltd (NYSE: TSM), Samsung Electronics Co. Ltd. (KRX: 005930), ICICI Bank LTD ADR (NYSE: IBN), HDFC Bank LTD ADR (NYSE: HDB), International Holdings Co. PJSC (1308.HK), Infosys LTD ADR (NYSE: INFY) and Al Rajhi Banking and Investment Company (TADAWUL: 1120).

This fund is down 3.84% over the past month, up 1.85% over the past three months and up 9.63% year to date. The fund has $334.8 million in assets under management, and it has an expense ratio of 0.16%.

Source: stockcharts.com

While this fund does provide an access point to the world of emerging markets, such an ETF may not be suitable for all investors. Investors should always do their due diligence before adding any stock, ETF or fund to their portfolio to make sure it is the best choice for their investing strategy.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.