Safety is an illusion perpetuated by global elitists clutching to their positions of power.

This isn’t some conspiracy theory borne out of misplaced anger.

It’s a truth laid bare by the actions taken by federal, state and local governments.

Let us give you an example.

We’ve been told Silicon Valley Bank (SVB) failed for two reasons:

- Depositors pulled money from the bank.

- This forced the bank to liquidate its U.S. Treasury investments at a significant loss.

However, this ignores the most important question: WHY were banks heavily invested in Treasuries?

The answer to this simple question leads to one inevitable conclusion…

…The Government Wants You to Lose Money!

In fact, for nearly half a century, our government has done everything in its power to redefine “safety” and make us rely on it more and more.

Everything from our homes to automobiles relies on the generosity of Uncle Sam.

So, what happens when the government decides to default?

Hopefully, it would strip away the facade blanketing our economy, and people will realize the extreme mispricing of assets.

However, despite all their efforts, the power brokers couldn’t destroy the one asset class capable of withstanding… well… virtually anything.

That’s not hyperbole.

There’s only one asset that performs decade after decade, through war and famine, booms and busts…

…And it’s an asset set to outperform this year, default or not.

Yes, it’s our good friend gold. It’s worked for over a thousand years and will for many more.

So, what exactly has the government done to discourage folks from owning the asset? And more importantly, what can we do to overcome the hurdles they’ve tossed in our way?

Let’s take a step back a decade-plus to the Great Recession.

Banks decided to make leveraged bets on mortgages because they were considered “safe.” After all, Americans always need homes, and the housing market had never failed before.

But, like drinking 20 beers, too much of a good thing can get you in a lot of trouble.

The problems grew beyond any statistical models, causing default insurance to… well… default.

Uncle Sam stepped in to save the day, bailing out banks while homeowners got kicked from their homes.

Legislators feigned anger, stripped banks of free market transactions and insisted they hold more safe assets.

Those safe assets were Treasuries.

A decade later, those safe Treasuries turned out to be toxic when you throw all your eggs into one basket.

Are you starting to see a pattern here?

Sure, many banks have hedges in place against their Treasury holdings. Do you think those will hold up if the government defaults on its debt?

This all started in 1971 when Richard Nixon took the United States off the gold standard, and not for inappropriate reasons. His hand was forced by the Bretton Woods Agreement of 1944.

Since then, the U.S. debt and its currency have decoupled from reality.

We have an economy where 70% is consumer spending, 20% is government spending and the remainder falls to business and trade. It’s built on a debt binge that underpins government and consumer spending…

…one that appears to be breaking down.

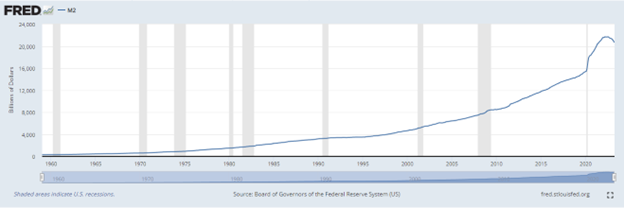

Take a look at the following graph, which shows the M2 money supply.

The M2 money supply is a measure of the total amount of money in circulation in the United States. It includes currency, checking accounts, savings accounts, money market funds and other short-term savings vehicles.

Since the Federal Reserve started tracking the money supply, M2 has increased virtually every year…until recently.

Think about that.

None of us has seen M2 supply decrease in our lifetime.

Our entire financial system…every one of our livelihoods is predicated on this never-ending merry-go-round.

We’re not saying this to scare you, but inform you of the severity of the situation.

Our banking system barely survived a bunch of venture capital vultures yanking money out of just one regional bank.

How do you think the U.S. and the global economy would fare if U.S. debt suddenly falls in line with Turkey’s?

It’s tough to count on a currency, even one as dominant as the U.S. dollar, when it’s manipulated by unelected officials who answer to no one.

That’s why hard assets with known value truly are the best weapon against everything from runaway inflation to geopolitical strife.

One person who knows this better than anyone is Mark Skousen, a famed economist and, we’d argue, a true realist.

Mark doesn’t wear rose-colored glasses nor subscribe to any ideology other than objectivity.

That’s why his latest discussion on the Biden Disaster Plan is a must-watch for anyone concerned about the direction of the country.

Stop worrying about what could happen and START acting on what will happen.

Click here to watch Mark’s latest video outlining his Biden Disaster Plan.