In my Successful Investing and Intelligence Report newsletters, I have written about how the contours of the future macroeconomic environment are likely to turn out in the wake of the economic problems caused by global central banks making decisions to increase interest rates to combat inflation.

But just to recap, I strongly feel that the future macroeconomic environment will be defined by three factors: slowing economic growth, largely due to high interest rates, falling inflation, as the effects of rising interest rates finally begin to make themselves known and finally central bank interest rate cuts to encourage economic growth in the wake of a contraction. In that environment, longer-dated fixed income bonds should outperform their rivals.

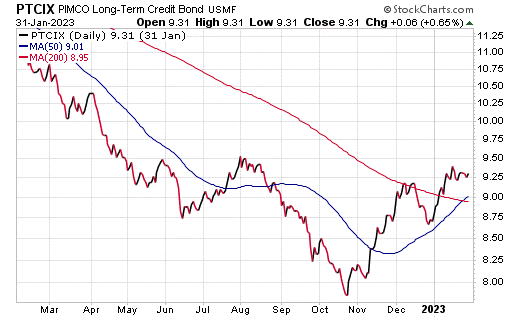

One such investment is the Long-Term Credit Bond Fund (MUTF: PTCIX). This is a fixed income mutual fund that seeks total return above its benchmark, consistent with preservation of capital and prudent investment management.

The goal is pursued through global macroeconomic analysis that focuses on maximum total return in terms of both income and capital appreciation by using long-duration, investment-grade corporate and sovereign bonds, as well as mortgages and foreign bonds. At the same time, since duration reflects, in part, a bond’s price sensitivity to interest rate changes, this strategy requires a greater tolerance to such changes.

Specifically, the fund’s portfolio is normally 80% of its assets in a combination of varying maturities, including forwards or derivatives such as options, futures contracts or swap agreements. Up to 20% of its total assets can be invested in junk bonds that are rated B or higher by Moody’s, S&P or Fitch. Unrated bonds appear in the portfolio if the fund’s managers deem them to have an equivalent rating.

As of Jan. 31, PTCIX rose 7.27% in the past month, 14.85% in the last three months and 7.27% year to date. As with any investment, it’s important to carefully consider one’s individual financial situation and goals before making a decision.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.