The utilization of uranium is a key component of nuclear energy, as the nuclear industry is propelled by the mining, refinement and delivery of uranium.

The Global X Uranium ETF (URA) offers investors exposure to a wide array of companies involved in both global uranium mining and its production. The exchange-traded fund (ETF) chooses companies that are purely involved in these pursuits or derive a large portion of their revenue from the uranium industry.

The companies that have revenues in the uranium industry are involved in uranium processes that include extraction, refinement, exploration and sometimes even manufacturing of the equipment for the uranium and nuclear industries. Created in 2010, URA provides exposure to nearly 50 global companies involved in the uranium industry.

URA has amassed $1.76 billion in net assets and $1.77 billion in assets under management. The ETF is a highly traded, with an average volume of more than two million shares per day. Moreover, URA provides a high yield of 6.02% and has an expense ratio of 0.69%.

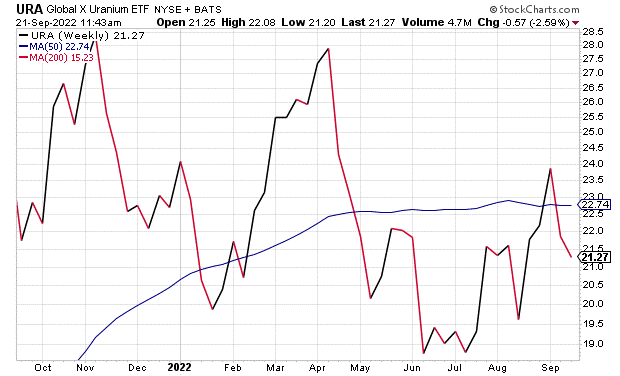

As evidenced in the chart below, URA has seen its share of ups and downs year to date, which is not unusual given the market uncertainty over the same time frame. However, while many stocks and sectors continue to falter, given the current inflation-rate debate, URA is rebounding.

In November 2021 and April this year, the ETF saw remarkable spikes.

Chart Courtesy of Stockcharts.com.

Nearly 72% of URA’s holdings are in the energy sector, and its top 10 holdings make up 70.45% of its total assets. These holdings include Cameco Corp. (CCO.TO), 23.43%; National Atomic Co. Kazatomprom JSC ADR (KAP), 22.81%; NexGen Energy Ltd. (NXE.TO), 5.36%; Denison Mines Corp. (DML.TO), 3.50%; Energy Fuels Inc. (EFR), 3.19%.

Ultimately, the Global X Uranium ETF is a nuclear energy play as it offers investors access to companies worldwide that participate in uranium processes including extraction, refinement, exploration and or manufacturing of the equipment for the uranium and nuclear industries.

So, while URA is a gateway to uranium and nuclear energy, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether a given fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.