Six of the best home building stocks to buy during the ongoing economic recovery from the COVID-19 crisis give investors an opportunity to profit from sharply increased demand for residential real estate.

The six best home building stocks to buy feature companies that develop and construct residential real estate, but also include businesses that serve in important niche segments of the industry.

Low Interest Rates and Economic Recovery Lift Six Best Home Building Stocks to Buy

“I do believe that home builders are going to benefit as interest rates stay low and the economy recovers from the pandemic,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “They’re also going to benefit longer term as the millennials age into prime home-owning years.”

However, home builders’ profitability is limited by shortages of labor and materials, said Carlson, who also leads the Retirement Watch investment newsletter. But labor and materials shortfalls help to prevent overbuilding and keep demand high, he added.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

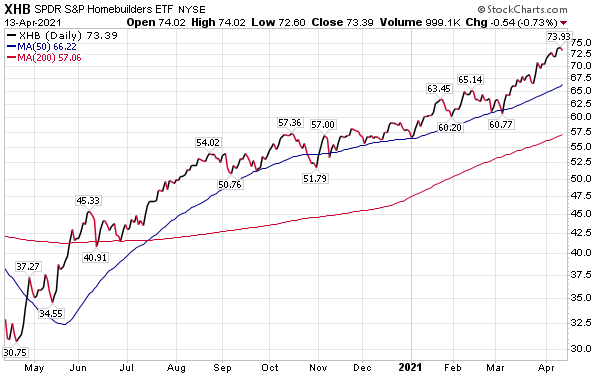

A good way to take a stake in the sector is by investing in SPDR S&P Homebuilders (XHB), an exchange-traded fund (ETF) that is up about 28.16% so far this year after zooming 129.15% during the past 12 months, said Carlson, who added he favors investing in a fund rather than the stocks of individual home builders. SPDR S&P Homebuilders is designed to provide investment results that correspond generally to the total return performance of the S&P Homebuilders Select Industry Index, before fees and expenses.

XHB, which trounced its category’s 27.54% return and its index’s 54.98% gain during the past year, seeks to give investors exposure to the home builders segment that is comprised of subsectors such as Building Products, Home Furnishings, Home Improvement Retail, Home Furnishing Retail and Household Appliances. The fund also is intended to track a modified equal-weighted index to allow for unconcentrated industry exposure across large, mid- and small-cap stocks.

Chart courtesy of www.StockCharts.com

Money Manager Kramer Picks Custom Harbor Development for Six Best Home Building Stocks to Buy

“Home builders were so busy in many parts of the country that they were actively turning business away early this year and it’s going to take at least a full construction season to work through that backlog,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and leads the GameChangers and Value Authority advisory services. “Likewise, mortgage brokers haven’t slowed down even though 30-year rates have rebounded about a half percentage point from the record low 2.66% that fed last year’s boom. Believe it or not, housing is still about as hot as it gets.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

With that in mind, it’s no wonder that broad thematic portfolios like the S&P Homebuilders ETF doubled over the past year and are up nearly 30% so far this year, Kramer continued. Longtime shareholders are “thrilled,” but a question remains about which stocks still have upside, she added.

“I’d start with the ones that are either too new to be heavily weighted in institutional portfolios or have lagged their peers,” Kramer said. “My top name in both categories is Harbor Custom Development Inc. (NASDAQ:HCDI), which went public in August and has quickly become one of my favorites.”

The company builds high-end and unique homes in Puget Sound, Washington. Pursuit of such an affluent niche indicates its margins can absorb inflation on the materials side, Kramer continued.

Chart courtesy of www.StockCharts.com

Lennar Corp. Wins Spot Among Six Best Home Building Stocks to Buy

“The housing market is perhaps hotter than any time since the late 2000s, only this housing boom isn’t based on funny money mortgages,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. “Rather, the metrics in the housing market are so positive because of a bullish combination of near-record-low borrowing rates on new homes, and what I call the COVID-19 pandemic flight to the suburbs that has stimulated home buying away from dense urban areas.”

Woods told me that that home builder Lennar Corp. (NYSE:LEN) is taking advantage of these bullish housing conditions.

“The company is one of the country’s biggest home builders, as it builds single-family homes, rental properties and commercial real estate in 21 states,” Woods said. “That mix of in its core business has helped LEN see its earnings growth surge, and last quarter its year-over-year EPS growth was 61%. That earnings power of late, as well as over the past several years, has put LEN in the top 5% of all public companies in terms of earnings growth.”.

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

On March 17, LEN shares spiked some 13% after the company reported outstanding fiscal first-quarter results. But one key announcement by the company that pleased traders was its decision to spin off some of its ancillary businesses, such as its multifamily business and technology startups. While management offered no clear timeline for the spin-offs, what the announcement did is reassure Wall Street that management will focus on the company’s bread-and-butter businesses. Moreover, the spinoffs will help smooth LEN’s earnings volatility going forward.

Chart courtesy of www.StockCharts.com

Advanced Drainage Systems Joins Six Best Home Building Stocks to Buy

Advanced Drainage Systems Inc. (NYSE:WMS), a Hilliard, Ohio-based manufacturer of plastic corrugated pipes and other drainage products, has soared 242.29% in the past year, soundly beating its sector’s 134.45% return and its index’s 57.39% gain for the same period. The company reported improving financial performance on Feb. 6, when its management held its third-quarter fiscal 2021 earnings conference call.

“We delivered another quarter of record financial performance in the third quarter of fiscal 2021,” D. Scott Barbour, president and chief executive officer of Advanced Drainage Systems, said during the call. “Sales grew 24% year-over-year, driven by 17% non-residential sales growth and 36% residential sales growth.”

Sales across each of the company’s end markets increased double-digit percentages in the fiscal third quarter, as demand in its non-residential market jumped 17%. Advanced Drainage Systems continues to benefit from growth in horizontal construction, such as warehouses, distribution centers, data centers and developments that follow the residential build-out.

Drainage Company Earns Place Among Six Best Home Building Stocks to Buy

Strength showed in the regions where the company has achieved growth, such as the Atlantic Coast and Southeast, Barbour said. The company also rebounded in regions like the Northeast and Western United States that had been softer this year, Barbour said.

In addition, allied product sales in the non-residential market increased 23%, boosting confidence in the underlying market strength. The company also continues to experience strength in its residential market with 36% growth in the quarter, driven by favorable dynamics in new home construction, repair/remodel and on-site septic, accelerated by the material conversion strategies at both businesses.

“Our indicators are showing that home builders continue to acquire land for future development and that there’s an overall shortage in available homes,” Barbour said.

The retail market, which is roughly 25% of the company’s residential sales, continues to experience strong growth, as well show continued strength in remodeling and home improvement, Barbour continued.

BoA Global Research set a price objective of $117 on WMS shares, based on fiscal year 2022 estimates for an adjusted enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA) multiple of roughly 17x — near the top end of the company’s historical range. Downside risks to that price target include a potential slowing in non-residential construction, U.S. single-family starts falling below historical trend, fairly high financial leverage relative to its building product peers, market challenges in Canada & Mexico, concentration of voting power and customers, rising raw material costs, slowing material conversion trends within key markets and a slowing U.S. economy.

Positive factors that could help the stock include a re-acceleration in non-residential construction, declining raw material costs and a quickening of material conversion trends within key markets, BoA concluded.

Chart courtesy of www.StockCharts.com

The Six Best Home Building Stocks to Buy Also Include Armstrong World Industries

Lancaster, Pennsylvania-based Armstrong World Industries, Inc. (NYSE:AWI), a designer and manufacturer of walls and ceilings, has a global manufacturing network of 26 facilities and a modest $98 price objective on it from BoA. AWI’s 2021 estimated P/E multiple of roughly 24x also is within the company’s historical valuation ranges since spinning off Armstrong Flooring in April 2016.

However, 2020 proved very challenging for many companies, including high-quality commercial construction focused manufacturing entities like AWI. BoA historically and to this day continues to view AWI among the best positioned, most resilient companies throughout a cycle.

Chart courtesy of www.StockCharts.com

Downside risks BoA cites are: 1) weaker than anticipated commercial construction activity, 2) slower than forecast share repurchases, 3) weaker than expected economic growth in North America, 4) a resurgence in COVID-19 outbreaks that leads to another round of construction market closures, 5) slower-than-expected return to the office, and 6) less municipal spending dedicated to non-residential rest and relaxation (R&R).

However, BoA provides reasons for optimism, too. The reasoning includes the potential for 1) stronger than anticipated recovery in commercial construction, 2) faster-than-expected recovery in mineral fiber AUV, 3) weaker-than- expected economic growth in North America, 4) an unexpected decline in COVID-19 cases, 5) faster-than-expected return to the office and 6) strong municipal spending on R&R for schools and other projects.

Six Best Home Building Stocks to Buy Feature D.R. Horton

D.R. Horton, Inc. (NYSE:DHI), America’s largest-volume home construction company, is headquartered in Arlington, Texas, and jumped 143.05% during the past 12 months to beat the 137.91% return of its sector and the 57.39% rise of its index. BoA set a $103 price objective on DHI shares, based on a fiscal year 2021 estimated price-to-earnings (P/E) multiple of roughly 11.5x, which implies a price/book multiple of roughly 2.9x.

At 11.5 x P/E and 2.9 x P/B, DHI would trade within its five-year valuation range, which BoA stated was appropriate given an improving home-building market that is offset by lingering economic risk due to COVID-19 and market fears of the potential for peak earnings in 2021. However, BoA cites downsides risks that include macro headwinds affecting first-time buyers, gross margin pressure on home sales or buying a greater percentage of land on option.

DHI also is at risk due to its speculative building strategy that may force it to discount prices, if demand is softer than expected. Other potential risks include a large and sustained increase in raw material costs, a continuing spike in mortgage rates, potential unwillingness to return value to shareholders through increased dividends and share repurchase and a slowing U.S. economy, according to BoA.

Chart courtesy of www.StockCharts.com

KB Home (NYSE:KBH), a Los Angeles-based home-building company, has been given a $54 price objective on its share price by BoA, based on a fiscal year 2021 estimated P/E multiple of roughly 9.5x. At 9.5 x P/E and 1.7 x P/B, KBH would trade within its recent historical valuation range, which BoA stated would be appropriate due to a solid housing market, offset partly by lingering risk of further COVID-19- induced economic slowing, market concerns about the potential for peak earnings in 2021 and growing affordability concerns.

Possible upside for KBH includes better-than-expected gross margins, faster-than-anticipated improvement in return on equity, de-leveraging through debt pay down, better-than-expected pricing power and better-than-expected leverage for its selling, general and administrative (SG&A) expenses.

BoA also listed the following downside risks: cost pressures on gross margins, slower-than-anticipated improvement in return on equity, an inability to de-lever its debt, softer-than-expected pricing power, worse-than-expected SG&A leverage and a weakening U.S. economy.

Chart courtesy of www.StockCharts.com

COVID-19 Fails to Collapse Six Best Home Builder Stocks to Buy

COVID-19 vaccination progress in recent months raises hope among many people who tired of lock downs that new cases caused by the virus may begin to slow rather than surge. Further optimism comes from the Food and Drug Administration (FDA) recently approving a third COVID-19 vaccine with Johnson & Johnson (NYSE:JNJ) to quicken the pace yet further at which people can be vaccinated. However, JNJ has faced some recent setbacks that include manufacturing problems that have limited its near-term prospects for fulfilling its potential as a vaccine maker.

U.S. COVID-19 cases have reached 31,345,992 and led to 563,446 deaths, as of April 14. COVID-19 cases worldwide have jumped to 137,467,864, with deaths totaling 2,959,675, according to Johns Hopkins University. America is the nation that has reported the most COVID-19 cases and deaths by far.

The six best home building stocks to buy give investors choices for how to profit from the $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and the ongoing economic reopening. Those three catalysts position the six best home building stocks to climb further during the rest of 2021 and beyond.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.