If time has anything to tell, it shows that one of the best dividend aristocrat stocks to buy amid the COVID-19 recovery include Texas-headquartered Exxon Mobil Corporation (NYSE:XOM).

A well-known oil and gas corporation, the company’s long history of strong performance in the oil industry is a testament to its business practice. Its consistent high dividend growth rate and 37 consecutive years of dividend payouts offer a great buy for investors.

About ExxonMobil (NYSE:XOM)

Multinational global and gas corporation Exxon Mobil Corporation, which operates as ExxonMobil, offers an 8.01% dividend yield. It is part of the elite Dividend Aristocrats that have boosted their dividend payouts for at least 25 straight years and has a market capitalization of $183 billion.

ExxonMobil is one of the major oil businesses that have been critically impacted by the COVID-19 crisis this year. It reported a $610 million net loss in the first quarter of 2020, compared to a $2.35 billion profit in the same quarter a year ago. However, this downturn is largely attributed to the dual impact of the COVID-19 financial crisis and the collapse of the OPEC deal this year. The company’s management has optimism from its long history of successful performance for ExxonMobil to rebound from this brief downturn.

Recent Earnings Performance of ExxonMobil

ExxonMobil reported an 11.7% drop in its revenues for the quarter ended March 31, 2020, compared to the same quarter a year ago. At the same time, its worldwide net production rose by 6.57%. The net loss is a result of a surplus in oil supply caused by the decline in demand paired with continued high production levels.

Moving forward, Darren Woods, chairman, and CEO of ExxonMobil emphasized the company’s focus on long-term growth and has confidence in its recovery from the short-term loss in demand.

“COVID-19 has significantly impacted near-term demand, resulting in oversupplied markets and unprecedented pressure on commodity prices and margins,” Woods said.

“While we manage through these challenging times, we are not losing sight of the long-term fundamentals that drive our business. Economic activity will return, and populations and standards of living will increase, which will, in turn, drive demand for our products and recovery of the industry.”

Its second-quarter earnings report will be released on July 31, 2020. It is set to present a summary of its earnings from April 1 to June 30 and show the ongoing effects of COVID-19 on the earnings of the company.

ExxonMobil Announces Retirement of President of Upstream Business

The company has recently announced the retirement of Steve Greenlee as President of ExxonMobil Upstream Business Development Company and Linda DuCharme has been appointed as the new President. DuCharme will retain her position as president of ExxonMobil Upstream Integrated Solutions Company and has also been elected as the vice president of Exxon Mobil Corporation. DuCharme joined ExxonMobil in 1986.

37 Consecutive Years of Dividend-Paying Increases

With 37 consecutive annual dividend-paying increases, ExxonMobil is a valuable Dividend Aristocrat, with an average dividend growth rate of 6.2% in its 37-year history. The company has a quarterly dividend of $0.87 that would convert to a $3.48 annual distribution and offer an 8.01% forward dividend yield. The payment marks a 6.1% increase in the annual dividend from 2019 to 2020.

ExxonMobil’s management is committed to maintaining a strong dividend policy and continued its dividend distribution of $0.87 for its second-quarter dividend payment on June 10, 2020.

Price/Book Ratio

ExxonMobil currently has a 1.02 price to book ratio, so it is trading slightly higher than its book value, after a brief drop of its price to book ratio to 0.85 for the quarter ended March 31, 2020.

Price/Earnings Ratio

ExxonMobil currently trades at a 16.37 trailing price-to-earnings (P/E) ratio, which is much lower than the international oil and gas industry P/E ratio of 27.70. This valuation of ExxonMobil compares advantageously to the industry average.

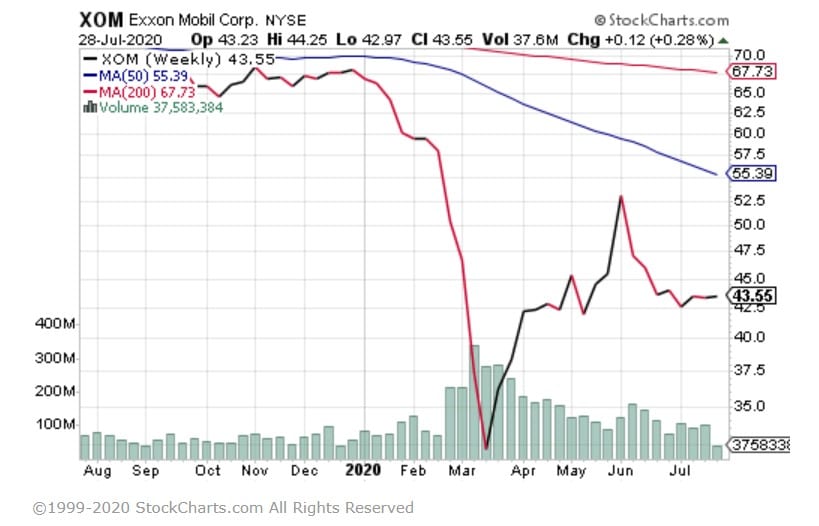

Recent Stock Price Performance

ExxonMobil’s recent stock price has fallen 37.8% so far this year, as of July 27, 2020. Its sharp decline started in January 2020 and is believed to be from the combined effects of dropping market demand during the global pandemic and the overproduction of OPEC suppliers. The stock slid from the $67 range in mid-January 2020 to its lowest price of $31.45 during a 12-month span. It has since risen 40.1% from its low on March 23, 2020.

Future Company Outlooks Include Cutbacks in 2020 Spending

ExxonMobil has announced a 30% reduction in capital spending and a 15% reduction in cash operating expenses in response to “low commodity prices resulting from oversupply and demand weakness from the COVID-19 pandemic.” Capital spending is now projected to be $23 billion, compared to the previously announced $33 billion. This cutback is expected to help the company withstand the short-term decrease in demand and free up funds to focus on long-term goals.

Despite the changes in spending, Chairman and CEO Woods remains optimistic about ExxonMobil’s long-term outlook and the company’s investments.

“Our objective is to continue investing in industry-advantaged projects to create value, preserve cash for the dividend and make appropriate and prudent use of our balance sheet,” Woods said.

Investors should BUY ExxonMobil for the following reasons:

- Although ExxonMobil has suffered financial losses due to COVID-19, its rebound and continued rise of 40.1% in stock price from a severe drop in March show market confidence in ExxonMobil’s future prospects.

- The company is predicted to recover with its long history of withstanding industry and market downturns, and its essential role in the international oil and gas industry. It would be a good investment to grab the stock while its share price is low.

- Its 37-year history of dividend growth and average dividend growth rate of 6.2% provides investor confidence.

- Trailing P/E ratio is low compared to the oil industry average.

Key Risks for ExxonMobil Include:

- Its future performance is subject to change by factors including global or regional shifts in the supply and demand of market conditions that impact prices and differentials, as well as government policies and actions.

- In response to COVID-19, business actions taken to protect the safety and health of employees and adverse effects on global economies and markets can change ExxonMobil’s future earnings.

- Reduced capital spending, cash operating expenses, and other potential cutbacks for 2020 could lead to a slowdown of recovery in the company’s operations.

Katie Kao is an editorial intern with Eagle Financial Publications and she writes for www.stockinvestor.com.