(Note: Today’s ETF Talk is the third in our series on funds that are likely to do well when the market begins a “V-shaped” recovery.)

The Global X MLP ETF (MLPA) invests in some of the largest, most liquid midstream energy master limited partnerships (MLPs) to give investment results that generally align with the price and yield performance, before fees and expenses, of the Solactive MLP Infrastructure Index.

The index fund focuses on transportation, storage and processing MLPs that often have less sensitivity to energy prices. Specifically, MLPA offers investors exposure to midstream MLPs in a C-corporation exchange-traded fund (ETF).

C-corporations, unlike many ETFs, pay taxes at the fund level. However, MLPs typically pay high yields to investors because they do not pay corporate income taxes. Plus, MLPA’s expense ratio of 0.46% is about 24% lower than the industry average.

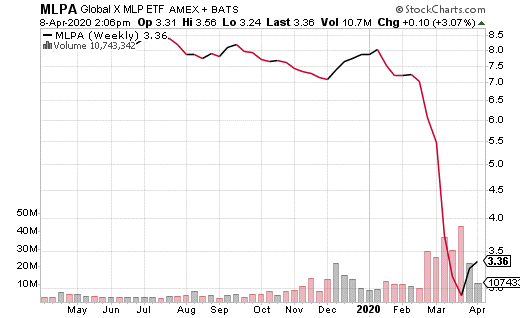

MLPA has $476.84 million in assets under management, an 0.18% average spread and offers a 22.55% dividend yield. Its next distribution date is May 7, 2020. MLPA’s share price dipped in late March but it has been rising lately after President Trump intervened in an oil production dispute between Russia and Saudi Arabia to lift oil prices after a recent plunge.

Source: StockCharts.com

This midstream energy ETF allocates 76.57% of its total assets to its top 10 holdings. MLPA’s top five holdings currently are Enterprise Products Partners LP (EPD), 12.52%; Magellan Midstream Partners LP (MMP), 11.26%; MPLX LP Partnership Units (MPLX), 7.80%; Cheniere Energy Partners LP (CQP) 7.59%; and Energy Transfer LP (ET), 7.38%.

In sum, the fund is aimed at providing exposure to midstream energy holdings that are on the rise with a recent upward move in oil prices. For investors looking to gain exposure to the energy sector, the ETF offers a chance to align with the largest and most liquid midstream MLPs.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.