A stock market crash threat is boosting the appeal of high-potential investments that offer a way to capitalize on a chance for share-price appreciation while seeking to limit the fallout from a severe drop.

Investors worried about the threat of a stock market crash still can produce outsized profits if they buy stocks and funds with the greatest likelihood to thrive in the long term regardless of what happens to the overall market. Risk also can be reduced by investing in equities that pay a dividend, which historically outperform non-dividend-paying stocks and funds for the long term.

One of the highest-profile and most respected champions of dividend-paying stocks is Jeremy Siegel, a finance professor at the University of Pennsylvania’s Wharton School. Siegel’s “Stocks for the Long Run” was named by the Washington Post as one of the 10 best investment books of all time.

Dividend-Paying Companies Can Help Dodge the Worst Fallout of a Stock Market Crash

Bryan Perry, who leads the Cash Machine advisory service aimed at offering high-yield payouts, specializes in recommending stocks and funds for income investors. Perry, who also heads the Hi-Tech Trader advisory service, urges investors who have cash available amid a volatile sell-off to consider buying stocks of companies that outperformed their latest quarterly estimates and are fundamentally, technically and institutionally “go-to” technology investments.

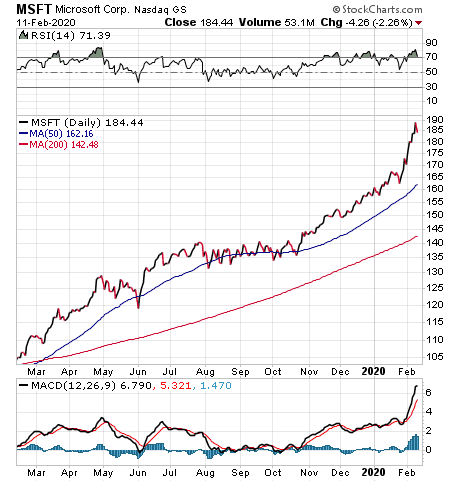

Stocks that measure up to that profile include Microsoft Corp. (NASDAQ:MSFT), offering a dividend yield of 1.08 percent, and Intel Corp. (NASDAQ:INTC), featuring a yield of 1.99 percent, Perry said. Both companies reported “stellar” fourth-quarter 2019 results and provided solid forward guidance for second-quarter and full-year 2020, he added.

Chart Courtesy of www.StockCharts.com

A key part of the growth of both companies comes from personal computers that are based on the Intel microprocessor and one of Microsoft’s Windows operating systems, Perry said.

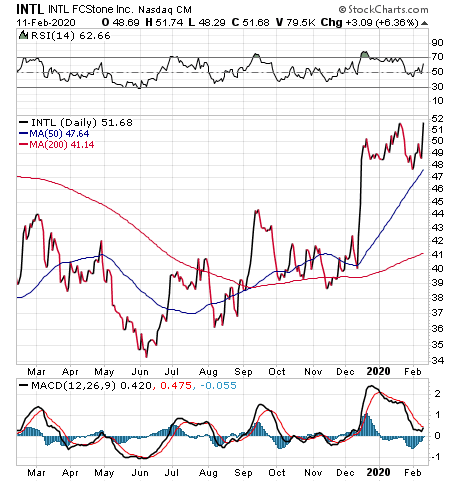

Chart Courtesy of www.StockCharts.com

Stock Market Crashes and Corrections Offer Buying Opportunities

Intel currently trades near Perry’s suggested entry price ceiling of $62, while Microsoft is trading well above his suggested limit of $164 a share. Patient investors who can buy under these prices after a significant pullback or an outright stock market crash would be acquiring “upside breakout” opportunities, he added.

If the market declines further, after its recent rebound, Microsoft and Intel “very likely” won’t lose much ground, Perry said. Instead, if the coronavirus fears and cases subside and the market responds favorably, both stocks offer prime investments.

Public health experts predict the coronavirus, which had caused more than 1,100 deaths and 43,100-plus infections as of Feb. 11, could subside in the summer months as the weather warms. If so, Perry’s forecast could prove prescient. However, the coronavirus could cause a second wave of infections in the fall when the temperatures cool again, just as occurs with the flu virus.

Defense against a Stock Market Crash Threat Features Inverse Funds

Investors who are worried about attaining superior investment returns but also fearful of the threat of a stock market crash should consider alternatives, said Bob Carlson, who leads the Retirement Watch advisory service and serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

“Too many investors think the investment world consists of stocks and cash,” Carlson said. “When they believe stocks will do poorly, they move more of their portfolios into cash. But there are a lot of other options, especially for aggressive investors or those who take more than average risk.

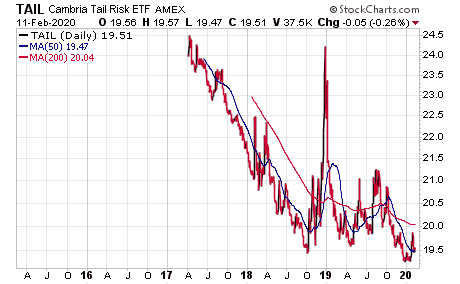

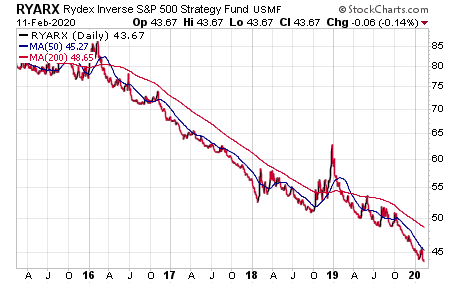

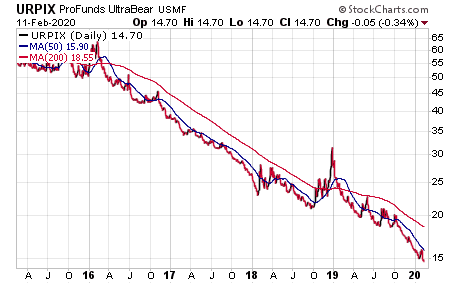

“When they believe the markets are in the early stages of a sustained downturn, they can buy options or futures contracts that rise in value when the stock indexes decline. Or they can buy a bear market mutual fund or ETF that buys the futures and options contracts. Examples are the Cambria Tail Risk ETF (TAIL), the Rydex Inverse S&P 500 (RYARX) and ProFunds UltraBear (URPIX).”

Chart Courtesy of www.StockCharts.com

Chart Courtesy of www.StockCharts.com

Chart Courtesy of www.StockCharts.com

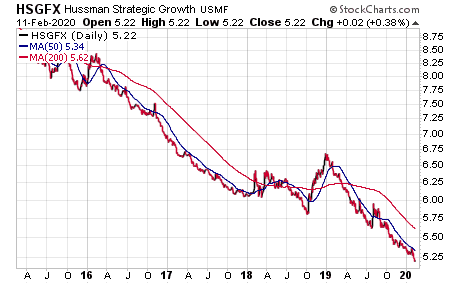

Another option is a tactical fund such as Hussman Strategic Growth (HSGFX), Carlson said. The fund uses proprietary models to determine whether its stock portfolio should be leveraged for a bull market, hedged for a bear market or be neutral, he added.

Chart Courtesy of www.StockCharts.com

“The fund appreciated during the tech market crash of the early 2000s,” Carlson said.

But that strategy relies on the accuracy of the fund’s model, Carlson cautioned. The fund has been hedged against a market decline for most of the current bull market, he added.

Bob Carlson answers questions from Paul Dykewicz during an interview.

Take Profits When Needed to Protect Against Stock Market Crash Threat

Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service, said investors who are aggressive or focused on growth need to be willing to take profits when the market is volatile and at risk of a crash or at least a correction of 10 percent or even more. The strategy of taking profits is especially good if one of an investor’s stocks has survived “a lot of the carnage,” Kramer added.

“You could get a chance to buy in at a better price later,” said Kramer, who also leads the Value Authority advisory service.

Paul Dykewicz interviews Wall Street money manager Hilary Kramer, whose investment advisory services include Turbo Trader, High Octane Trader and Inner Circle.

In addition, investors can “lower the octane” of their investments, Kramer suggested. Instead of buying a stock has could grow 25 percent but trades at 60 times earnings, buy a stock that offers 10 percent growth but sells for just 25 times earnings, she added.

“This leaves you with more margin for error if earnings grow slowly or the market continues to decline,” Kramer said. “You are still investing in a company growing much faster than average while taking on less risk.”

Highly Risk-Averse Investors May Fight Threat of Stock Market Crash with Dollar-Cost Averaging

New investors or those who are highly averse to risk may prefer to buy growth stocks by using dollar-cost averaging, Kramer said. Such investors could put 10 percent of their investable funds in the market, then contribute another 10% each quarter until becoming fully invested, she explained.

“If the market declines, you will have dollar-cost averaged down nicely, and be fully invested in 2.5 years, by which time the worst should be over,” Kramer said.

Investors who already have a portfolio and are fully invested could consider buying puts on a stock to protect a portfolio, Kramer continued.

Put Options Offer Another Way to Avert Threat of Stock Market Crash

“If you have a stock worth $60, you could write a $55 put with an expiration in six months’ time against it,” Kramer said. “For the cost of the premium, you limit your loss to $5 a share over six months.”

Conservative investors could reverse the strategy by writing call options on a stock to produce income, Kramer said.

The investment firm Schwab emphasizes diversification as “very important.” Even though the financial sector seems poised to outperform the market during the next three to six months, investors who concentrate in too few sectors can dramatically affect their portfolios’ risk profile and performance, Schwab cautioned.

Investors seeking to beat the market indices have viable ways to reach their goal without putting their funds into cash and accepting a negligible return on their money. Dividend-paying stocks, inverse funds and put options are among the strategies that are available for investors who want to avoid the worst of a stock market crash but also obtain better-than-average returns regardless of the market’s movements.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.

![[two bears]](https://stage8.stockinvestor.com/wp-content/uploads/7937304368_ece8985ecc_b.jpg)