On Tuesday, we saw modest declines in the stock market that were driven by fears of an economic fallout from the rapidly spreading Wuhan coronavirus. As of this writing, there have been 17 confirmed deaths and some 540 cases of infection, and that number is bound to soar in the days and weeks to come.

Undoubtedly, the sensationalism in the media over the possible threat of a global pandemic will spike, because there is no more eyeball-grabbing headline than the threat of Armageddon. So, considering the situation remains in the nascent stages, I wanted to assuage any fears you might have about this situation. And because this publication is committed to peeling off the top layers of the onion skin on any issue, I’m also going to provide you with some ways that you, as an investor, can make money buying the Wuhan virus.

To do that, I enlisted the expert help of my friend, macro analyst extraordinaire, and contributor to my Intelligence Report and Successful Investing newsletters, Tom Essaye, founder and editor of the highly recommended Sevens Report.

The following is a conversation I had with Tom last night regarding the Wuhan virus and its market implications.

Jim Woods (JW): Based on my reading, the Wuhan coronavirus is a strain of the more common coronavirus that gives us mild upper respiratory infections. That sounds very similar to the SARS virus that became a big threat in 2003, and the MERS virus that caused a scare in 2012.

Tom Essaye (TE): It sounds like a case of viral déjà vu to me. The only reason it’s called the Wuhan coronavirus is because it originated in Wuhan, China, and all the cases in other countries have been traced back to people who visited Wuhan recently. Scientists think the virus was alive in an animal (probably a fish) and made the jump to people there.

JW: That’s scary, but that’s also nature.

TE: Yes, it is. It also scared markets, because the spread of the virus and the implication that it might be transmitted through human contact is what hit stocks on Tuesday. That fear is compounded by the fact that the Chinese New Year is on Saturday, and travel within China around the New Year is similar to the week of Thanksgiving here in the United States, so there is the possibility this virus could spread rapidly.

JW: From an economic standpoint, fears of an epidemic are definitely not good. I think that’s likely the reason stocks were down on this news.

TE: The concern here is that people in China might sit out the New Year for fear of getting sick, which will hurt the Chinese economy and make a global economic rebound (which is priced into stocks) less likely.

JW: Well, if the virus does spread globally, that would make the negative economic impact much larger and, as you mentioned, given that a global economic rebound is priced into stocks, that would obviously be a headwind for markets.

TE: I agree. Yet you know me, I’m always looking for a silver lining in any situation, and a way for investors to seize the opportunity.

JW: Yes, I know, and that’s why I love you.

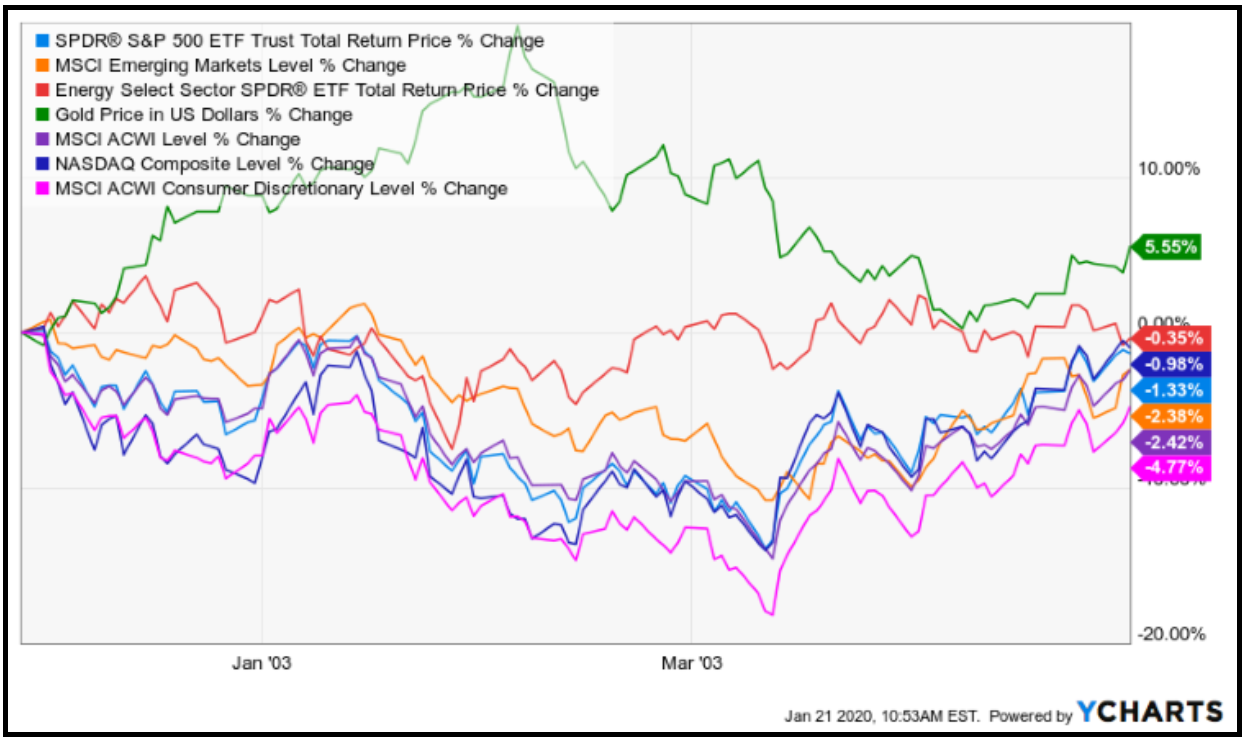

TE: (Laughs). In all seriousness, since this disease is closely related to SARS, I think the market reaction to the SARS outbreak gives us a good template to follow. That’s why I went back and looked at market returns during the SARS scare, which I dated roughly from December 2002 through April 2003. I then looked at cross asset returns to see what fared the best.

JW: I remember that period well. I was freelancing as a writer/book editor then, and I was happy that I didn’t have to do any overseas travel. I was also happy that I was trading gold during that time, as it was one of the few asset classes that held up to the scare.

TE: That’s exactly right. In fact, gold gained nearly 6% over that time frame and rallied nearly 20% at the highs on a general risk-off move in markets. Moreover, during that five-month period anything related to discretionary spending or the emerging markets/China underperformed, which is exactly what we’d expect. Global consumer discretionary stocks fell nearly 5%, while emerging markets and global stocks fell 2.5%. The S&P 500 and Nasdaq both saw smaller declines, but it’s important to note that the lows over that period were substantially worse than the final result, as all of those indices (S&P 500, Nasdaq, ACWI, Emerging Markets, Global Consumer Discretionary) each fell more than 10%. So, there was volatility over that time period.

JW: So, besides gold, where do you see the opportunities for investors if the Wuhan virus does turn out to be a SARS-like event?

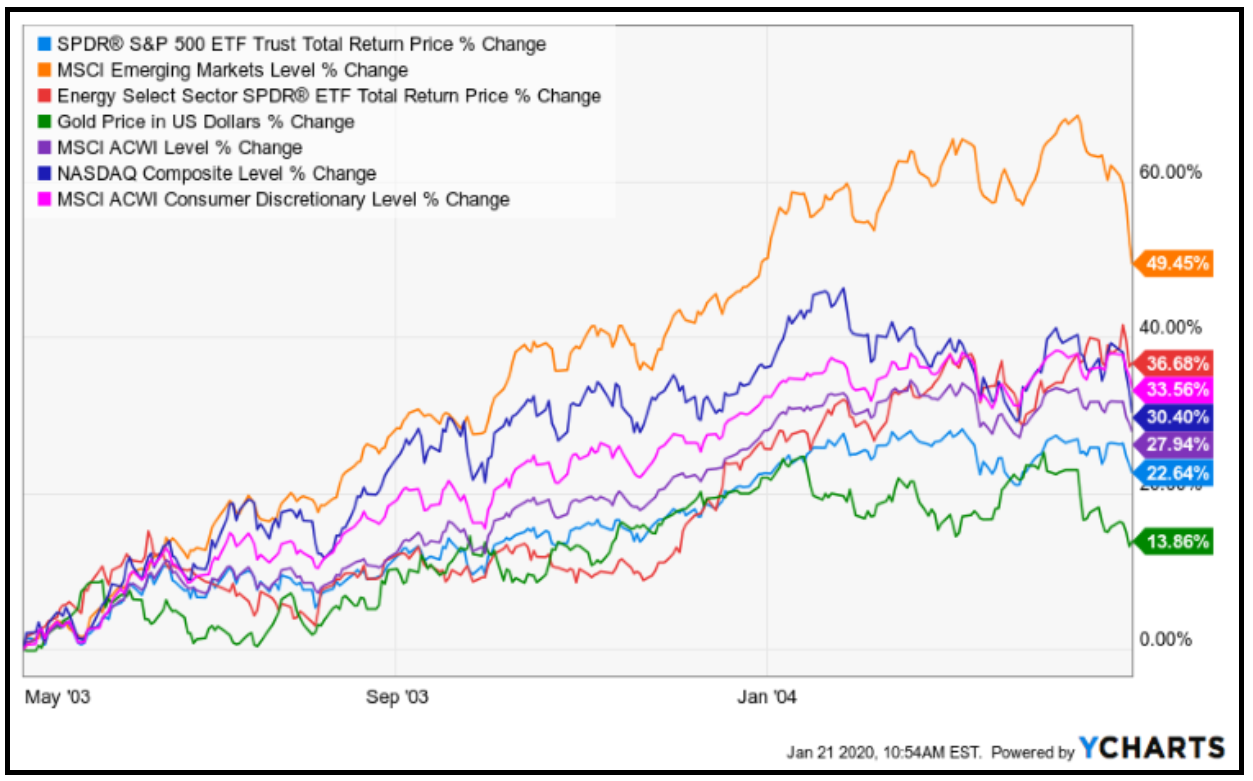

TE: I’m glad you asked that, because I also took a look at the same basket of indices and sector performance over the ensuing 12 months (May 2003 through May 2004), and emerging markets were the clear winner. While all the major indices rebounded, the MSCI Emerging Markets index returned more than 49% over the next year and traded as high as 60% over the following year.

JW: That’s very interesting, particularly because the current risk/reward in emerging markets is very positive. I’ve already mentioned this to my readers, but I currently see a bullish confluence of factors when considering emerging markets, e.g. low valuations, Chinese fiscal stimulus, the phase one trade deal between the U.S. and China and the resulting expectation of a global growth rebound. Together, I think these factors support the bullish case for emerging market equities such as those in the iShares MSCI Emerging Markets ETF (EEM).

TE: I agree. And notably, EEM fell 2.5% on Tuesday due to Wuhan virus fears. To me, that pullback is likely to represent a very good opportunity for investors to begin to “leg into” an emerging market position over the next few days/weeks on any extended EEM weakness. And though Wuhan does look scary, looking through my lens it just looks a lot like SARS. And as I just told you, emerging markets were the contrarian play out of the SARS scare back in 2003/2004, and that could definitely be the case again.

JW: Thanks, Tom. Whenever I need a smart opinion, it’s comforting to know that I can chat you up.

TE: Anytime, Jim. Now stop thinking about markets and go feed your horses.

**************************************************************

Reminiscences of Intellectual Activism with a Fellow Idea Warrior

When two friends who’ve known each other for more than three decades get together to reminisce about their mutual passion for ideas, literature, career and living the Renaissance Man ethos, you know you’re in for an auditory treat.

And that’s exactly what you get in this episode of the Way of the Renaissance Man podcast, as I speak with my good friend, writer, filmmaker and intellectual activist Stewart Margolis.

During this discussion, you’ll learn how Stewart and I began our adventures in idea advocacy while students at UCLA, and how we’ve continued to promote those ideas throughout the decades.

You’ll also learn about Stewart’s years living the life of a financier in Bermuda; his various film and screenwriting projects, and his work with the Ayn Rand Institute.

If you’ve ever wanted to eavesdrop on two friends ruminating on their mutual love of reason, passion and staying in the moment, then this episode was made for you.

******************************************************************

Hold the Restless Dreams of Youth

Any escape might help to smooth

The unattractive truth

But the suburbs hold no charms to soothe

The restless dreams of youth

–RUSH, “Subdivisions”

I could draw from Neil Peart’s prodigious body of work for years, but I promise I will be judicious in my use of “The Professor’s” wisdom. Yet because the wound of his passing remains raw in my heart, I thought I’d give you an excerpt from one more lyrical passage that helped shape my mind as a young man.

Upon hearing the band’s brilliant critique of social conformity in the song “Subdivisions,” I knew that I had to go out and explore what the world had to offer me. Perhaps that’s why I’ve tried my whole life to be a Renaissance Man, and to do many different things as well as I can. And though I am middle aged now, my restless dreams of youth continue to fuel my passion for life. May that spirit also animate you on your life’s journey.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods