After losing more than 55% over a five-year period, the Ford Motor Company (NYSE:F) saw its stock regain one-third of its value over the past six months.

While total sales were 4.1% lower than during the same period last year, Ford managed to deliver positive financial performance compared to last year’s results. Building on the strengths of the financial results, steady dividend income distributions and potential future gains as a result of a deep business reorganization, Ford might be a stock to offer robust returns over the extended time horizon.

Unlike its Big Three peers — General Motors (NYSE:GM) and Chrysler — which experienced significant financial or structural turmoil in the aftermath of the 2008 financial crisis, Ford managed to get through the same crisis relatively unscathed and without government bailouts. With GM and Chrysler in trouble, Ford appeared to be in the driver’s seat and on its way to take the lead among the big U.S. automotive manufacturers.

However, the competitive landscape in automotive market has changed subsequently. Ford’s apparent advantage seems to have disappeared and the tables might have turned on Ford.

After filing for bankruptcy in the aftermath of the 2008 crisis, Chrysler merged with the Italian automotive giant Fiat to form the Fiat Chrysler Automobiles N.V. (NYSE:FCAU). Assisted by a controversial government bailout procedure, GM went through Chapter 11 bankruptcy proceedings and emerged on the other side in 2009 as an entirely new business entity — the General Motors Company (NYSE:GM).

Business Restructuring

After failing to take advantage of its competitor’s difficulties and assume a leading position among the U.S. auto manufacturers, Ford found itself in similar financial and operational problems. While Ford continues to perform well in the truck market segment, the company’s passenger car lineup has been struggling.

For instance, in the second quarter of 2019, Ford sold more than 650,000 vehicles in the United States, which was 4.1% lower than in the same period last year. While sales of sport-utility vehicle (SUV) sales declined 8.6%, the largest drop of 21.4% was for passenger cars. However, Ford’s truck sales — which account for nearly half of the company’s volume in North America — increased 7.5% year-over-year.

During its first-quarter 2018 earnings call, Ford announced that it would focus on the truck segment and minimize its car lineup for the North American market. As indicated, the company has ceased production of most car models since the announcement 18 months ago. The production of the Focus model stopped in May 2018, with the production of the Taurus and Fiesta models terminating in March and May 2019, respectively. Ford’s current car lineup comprises only the company’s iconic Mustang brand and the Fusion model.

Ford had planned to introduce 50 new vehicle models over the next seven years into the Chinese market to generate a significant share of its global revenue. However, the still unresolved tariff situation and the economic slowdown in China reduced the demand for passenger cars and Ford’s sales in that market declined more than 30% in 2018.

Share Price

Following a downtrend for nearly five years, the share price passed through its 52-week high just one week into the current 12-month period. The share price peaked at $11.25 on July 10, 2018. After declining steadily through the end of October 2018, the share price showed indications of a trend reversal during November. However, the overall market downturn in late 2018 overcame the Ford stock’s weak recovery and pushed the share price towards its 52-week low of $7.63 on December 24, 2018.

However, after bottoming out on Christmas Eve, the share price has reversed direction and has been rising steadily since then. By the end of trading on July 3, 2019, the share price has risen to close at $10.20. This closing price was still 7.2% lower than it was at the beginning of the trailing 12-month period in early July 2018. However, the share price has gained nearly 34% since its 52-week low six months ago.

Furthermore, after nearly a year below the 200-day moving average, the share price recovery pushed the 50-day moving average back above its 200-day counterpart in a bullish manner on May 6, 2019. By the end of trading on July 3, 2019, the 50-day average had risen to nearly 10% above the 200-day moving average. Also, except for three brief dips below the 50-day average, the share price has been trading above both averages since early April 2019. These technical indicators suggest that the current share price uptrend might have enough fuel to maintain its upward trajectory.

Dividend

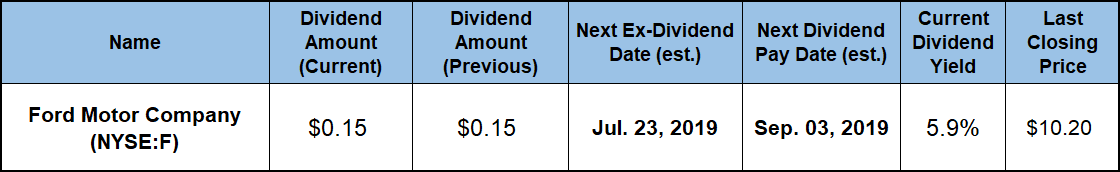

The company’s current $0.15 quarterly dividend distribution corresponds to a total annual payout of $0.60 per year. This annualized amount is equivalent to a 5.9% dividend yield, which is 2.5% higher than the company’s own 5.74% five-year yield average. While only slightly higher than Ford’s current yield, the 5.9% yield is 215% higher than the 1.87% average yield of the entire Consumer Goods sector.

The current yield outperformed the 1.73% average yield of the Major Auto Manufacturers industry segment by an even larger margin of 240%. Even compared to the 3.47% average yield of the segment’s only dividend-paying companies, Ford’s current yield is still 70% higher.

Ford Motor Company (NYSE:F)

Based in Dearborn, Michigan, and founded in 1903, the Ford Motor Company designs, manufactures and markets cars, trucks, SUVs and electric vehicles under the Ford, Lincoln and Troller brands. Additionally, the company’s Financial Services segment — Ford Credit — offers various automotive financing products for its automotive dealers and customers. The company also develops new automotive technologies through strategic partnerships with the Panasonic Corporation of North America and Qualcomm Technologies. Additionally, the company is dedicating significant resources to diversify its portfolio with new technologies and product lines. To streamline its hybrid, electric and autonomous vehicles development efforts and costs, Ford is forging partnerships with industry peers, such as the partnership with Volkswagen AG (FWB:VOW).

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.