The Consumer Discretionary Select Sector SPDR Fund (XLY) tracks a market-cap-weighted index of consumer-discretionary stocks drawn from the S&P 500.

Consumer discretionary involves goods and services consumers consider to be non-essential, but desirable, if available income allows such purchases. This sector primarily includes industries such as retail, automobiles and components, consumer durables, apparel, hotels and restaurants.

The index includes Amazon (NASDAQ: AMZN), Home Depot (NYSE: HD), McDonald’s (NYSE: MCD), Nike (NYSE: NKE) and Ford (NYSE: F). XLY delivers a cheap, liquid portfolio of large-cap consumer-discretionary stocks.

XLY’s basket of stocks is intended to represent the sector well, despite concentration in the largest names. The fund pulls its holdings from the S&P 500, which differs from the broad-market universe used by competing funds, since this one excludes small-caps and most mid-caps. Industry biases are small. Overall, XLY represents the space well at low all-in cost.

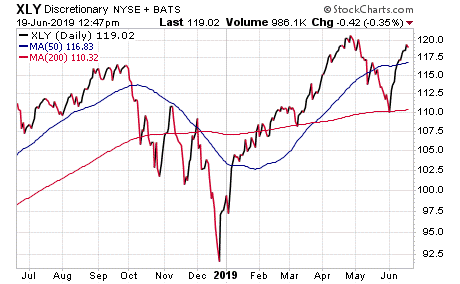

Chart courtesy of StockCharts.com

XLY has almost $14 billion in assets under management and an average spread of 0.01%. The fund’s expense ratio of 0.13% ranks among the lowest in the segment, so it is much cheaper to buy compared to other exchange-traded funds. This fund’s trading volume towers over its competitors with an average of more than $483 million.

As for its riskiness, the Consumer Discretionary Select Sector SPDR Fund has an MSCI ESG Fund Rating of BBB, based on a score of 4.45 out of 10. The MSCI ESG Fund Rating measures the resiliency of portfolios to long-term risks and opportunities due to environmental, social and governance factors. ESG Fund Ratings range from best (AAA) to worst (CCC). Top-rated funds buy shares in companies that tend to show strong and/or improving management of financially relevant environmental, social and governance issues.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

In the name of the best within us,

Jim Woods