The American Electric Power Company, Inc. (NYSE: AEP), a public utility holding company based out of Columbus, Ohio, rewarded its shareholders with capital gains of 21% and a total return of almost 25% over the past 12 months.

The company’s share price has experienced moderate volatility and failed to break above the $50 resistance level for decades before the 2008 financial crisis. However, after losing more than half of its value during that crisis, the share price embarked on a steady uptrend with minimal volatility for more than a decade.

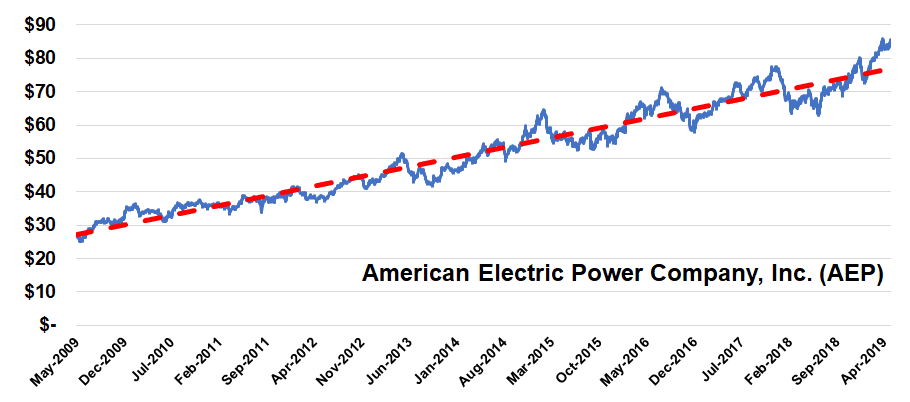

The graph below illustrates the steady growth of the American Electric Power Company stock over the past 10 years. The share price advanced 240% from below $25 in May 2009 to the current $80-plus level. This pace of advancement corresponds to an average annual growth rate of 13%. Correspondingly, the annual advancement is equivalent to an average growth rate of 1% per month over the past 10 years. Additionally, the graph also indicates the low level of share price volatility. The largest pullback over the past decade occurred from November 2017 to February 2018 and was only 18%.

The 18% share price pullback in early 2018 and the share price’s continued sideways movement in the first half of the year pushed the 50-day moving average below the 200-day average. However, its share price growth since mid-2018 has pushed the 50-day average back above the 200-day average and the gap between the two continues to widen. At the end of April 2019, the 50-day moving average was almost 9% above its 200-day counterpart. More importantly, except for two brief dips below the 50-day average in late September 2018 and early January 2019, the share price remained above both moving averages. From a technical analysis standpoint, this pattern is a good indication that the share price might extend its current uptrend for at least the next couple of periods.

Financial Results

In addition to positive technical indicators, positive financial results provide additional support for a potential continuation of capital gains. On April 25, 2019, the American Electric Power Company reported the results for the first quarter of 2019.

The company increased total revenues only marginally from $4.0 billion in the first quarter 2018 to $4.1 billion for the current period. However, earnings advanced 26% from $454 million to $573 million or $0.96 per diluted share. Adjusted earnings rose 24% from $0.96 to $1.19 per share. Furthermore, the adjusted earnings per share beat analysts’ expectations of $1.11 by nearly 7%.

On the strength of the first-quarter results, the American Electric Power Company reaffirmed its guidance for full-year 2019. The company anticipates earnings per share (EPS) in the $3.97 to $4.17 range. Additionally, the adjusted earnings are anticipated to range between $4.00 and $4.20 per share.

American Electric Power Company, Inc. (NYSE: AEP)

Headquartered in Columbus, Ohio and founded in 1906, the American Electric Power Company, Inc. operates through four business segments. The Power Generation segment operates approximately 60 generating stations with a total generating capacity of approximately 26,000 megawatts. Furthermore, this segment owns, leases or controls approximately 3,700 railcars, 470 barges, 11 towboats and a coal handling terminal with approximately 18 million tons of annual capacity. With more than 40,000 miles of high-voltage lines, AEP’s Transmission segment is the nation’s largest electricity transmission network. The Regulated Utility Operations segment consists of seven regional electric utilities serving nearly 5.4 million customers in 11 states. Lastly, the AEP Energy Partners segment provides customized wholesale power supply products in deregulated electricity markets to other electric utility companies, municipalities, rural electric cooperatives and utility customers with specific power supply needs and risk profiles.

Dividends

The current $0.67 quarterly dividend is 8.1% higher than the $0.62 payout from the same period last year. This new quarterly payout corresponds to a $2.68 annualized amount and currently yields 3.13%. Because the share price growth outperformed the pace of dividend hikes, the current yield is 5.7% below the company’s own 3.38% five-year yield average. However, while trailing its own five-year average, the current 3.2% yield outperformed the 2.09% average yield of the overall utilities sector by 53%, as well as the 2.24% simple average yield of the Electric Utilities subsegment by 42%.

Since skipping a dividend hike in 2009, the American Electric Power Company enhanced its annual dividend by 63%. This advancement corresponds to an average dividend growth rate of 5%. American Electric Power will distribute its next dividend on the June 10, 2019 pay date. All shareholders of record prior to the May 9, 2019 ex-dividend date will be eligible to receive the distribution.

Share Price

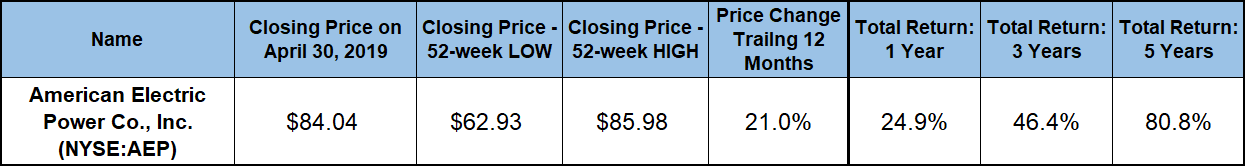

Still on the slight pullback that began in late 2017, the share declined 9.4% at the onset of the trailing 12-month period. The share price reversed direction and embarked on its current uptrend after reaching its 52-week low of $62.93 on June 11, 2018. The share price dipped slightly along with the overall market in December 2018. However, the share price had recovered fully from that dip by late February 2019 and continued rising to gain nearly 37% above its June low by the time that the price reached its new all-time high of $85.98 on March 26, 2019.

Since peaking in late March, the price pulled back 2.3% to close at $84.04 on April 30, 2019. This closing price was 21% higher than it had been one year earlier and was also 33.5% above its 52-week low from June 2018. Additionally, the current closing price was 61% higher than it was five years ago.

The combined benefits of robust share price growth and rising dividend income distributions have rewarded shareholders with a total return of 25% over the past 12 months. Over the past three years, the 46.4% total return was nearly twice the one-year return. Furthermore, the total returns over the past five years have exceeded 80%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.