The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI).

Specifically, industrial robotics and automation, non-industrial robots and autonomous vehicles are among the products and applications the companies targeted by BOTZ are pursuing. This exchange-traded fund (ETF) gives investors market-cap selected, cross-sector and weighted exposure to companies involved in the production of robots and the development of AI.

Eligible companies are listed using the Indxx Global Robotics & Artificial Thematic Index and must earn a significant portion of their revenue from or have a stated business purpose in robotics or AI. This field includes varied applications from the development of drones to health care robots and predictive analytics software. Viewed through traditional sector classification systems, BOTZ leans heavily towards industrials and technology.

The fund’s top holdings include Keyence Corp. (OTCMKTS:KYCCF), Mitsubishi Electric Corp. (OTCMKTS:MSBHY), Intuitive Surgical, Inc. (NASDAQ:ISRG), Fanuc Corp. (OTCMKTS:FANUY) and ABB Ltd. (NYSE:ABB). Although BOTZ is heavily weighted in technology and industrials, its other top sectors are health care, energy and basic materials.

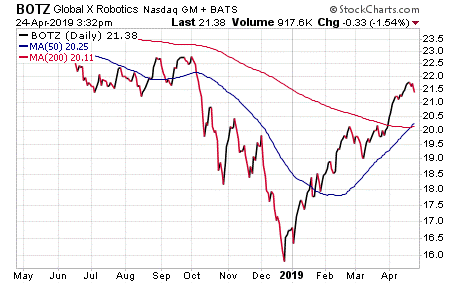

Chart courtesy of StockCharts.com

The ETF has $1.75 billion assets under management, an average spread of 0.05 percent and 34 holdings. With an expense ratio of 0.68 percent, it is relatively expensive to hold in comparison to other funds.

To sum up, BOTZ enables investors to access high-growth potential through companies involved in the design, creation and application of programmable automated devices. The fund’s composition transcends sector, industry and geographic classifications by tracking an emerging theme, although the ETF also is heavily weighted toward certain segments.

As a reminder, investors should conduct their own due diligence to decide whether this ETF is suitable for their portfolio. Investors also should ensure the ETF’s potential volatility fits within their level of risk tolerance.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.