Over the past two articles, I digressed from the discussing selection factors to discuss in more detail the Cash Flow Statement and the dividend-to-Net Operating Cash Flow. However, I will revert now to discussing additional retirement income investment equity selection factors. In this article, I will go lay out the basics of the Return on Invested capital (ROIC).

The ROIC measures the management’s ability to convert their investments into increased revenue and, more importantly, increased Net Operating Cash Flow, as this is from whence dividends are paid. With few exceptions, the inability to increase the Net Operating Cash Flow will almost certainly lead to either a flat dividend or a dividend reduction — a dividend cut. In my view, this is probably the most important metric to a true retirement income investor for predicting the future dividend-paying ability of a company.

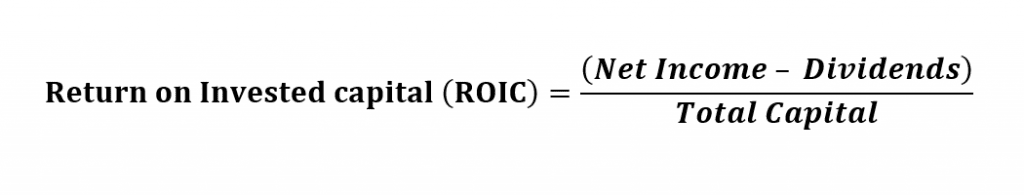

ROIC is an often-reported non-GAAP metric that can be calculated in more than one way. The most common, and perhaps simplest formula is:

Variants of this may reduce net income by taxes paid or may remove excess cash and non-interest-bearing liabilities from Total Capital. I am certain that there are many other ways to measure this.

From the standpoint of reliable and growing dividends for your retirement income, it is important to have some measure of how the investments reported on the Statement of Cash Flows perform. Are the investments providing the cash flows the original analysis said they would? Is management competent in choosing which investments the company will purchase and then getting the required net cash flow growth from those investments in excess of the cost of the capital used to finance them? This is one of the key measures of an effective CEO — the ability to clearly interpret the quantitative analysis of any prospective investment and then use experience to determine the potential value of each investment. The CEO must qualify whether an investment in a particular market and under particular economic conditions will be the revenue and Net Operating Cash Flow generator that the company expected. This process is part science and part art form.

While CEOs of large companies who have demonstrated this ability make the decision process look easy, the process is not easy at all.

Calculating ROIC

I have not seen printed or mentioned anywhere else the formula that I propose here. However, the formula makes sense to me. I add up the net Cash used For Investing Activities for five consecutive years as a total net payout. In the example of WEC, from the Morningstar provided Statement of Cash Flows, this totals up to (in millions):

$634 + $893 + $730 + $746 + $740 = $3,743 million spent on investing activities for 5 consecutive years.

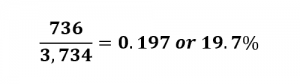

Next, I calculate how much the revenues have grown over this five-year period. The first year’s Revenues totaled to $4,203 million while the 5th years totaled to $4,939 million, showing a growth of $736

Dividing the five-year revenue growth by the same five-year total investing expense gives us

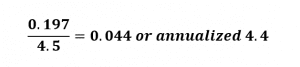

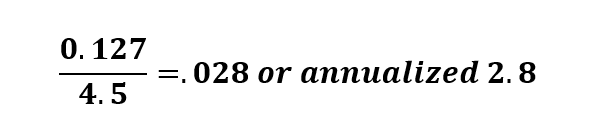

Dividing this by 4.5 years – 2010 through mid-2014 – gives us:

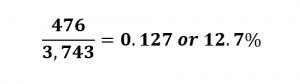

Doing the same ROIC calculation for the Net Operating Cash Flow gives the change in Net Operating Cash Flow as 1,286 – 810 = $476. Thus, the Return on Invested Capital for Net Operating Cash Flow is

Dividing this by 4.5 years gives us an average annualized ROIC over this 4.5-year period of:

I, then repeat this calculation in the Excel spread sheet for each of the past five-year periods using the 10-year history provided by Morningstar. Please note that if you do not subscribe to Morningstar premium, you can get a 10-year history from https://amigobulls.com as mentioned in the previous article. However, a five-year history is available from Bloomberg, Google Finance and Market Watch, as well as other sites.

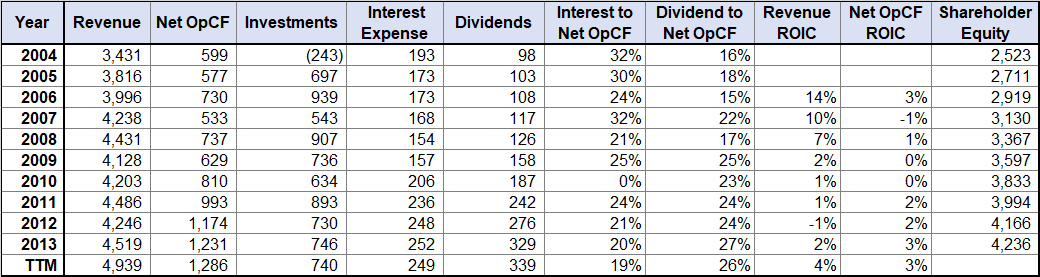

I copy and paste the yearly data into the Excel table below. The Revenue and Interest Expense are from the Earnings Statement, Shareholder Equity information is from the Balance Sheet and the Net Operating Cash Flow, the Net Cash Provided by (used for) Investing Activities and the Dividends Paid information are from the Statement of Cash Flows.

For each of these, I copy and paste the numbers shown in the financial statements into the below table one row at the time. I convert the negative numbers for Investments and Dividends to positive by multiplying each value by -1.

After entering the base data into the table, I set up formulas to calculate the other values and indicators that I need.

Interest to Net Operating Cash Flow = Interest Expense divided by the Net Operating Cash Flow (NetOpCF) + Interest for each year.

Dividends to Net Operating Cash Flow = Dividends divided by the ‘Net Operating Cash Flow number for each year

Additionally, I create formulas in Excel to calculate Revenue ROIC and Net Operating Cash Flow ROIC following the method explained above in the “Calculating ROIC” section of this article.

If you are not familiar with the functions of Excel, you can use a calculator to compute these numbers. However, setting up this table in Excel will allow you to use the same table for making these calculations repeatedly as you analyze many stocks in the future.

Below is the 10-year data for WEC:

I am using a 10-year history in this table. Please note that for the 2006 Revenue ROIC and Net Operating Cash Flow ROIC, I only can use three years of data (2004-2006) and for 2007 only four years (2004-2007). Calculations for all other years in the table use the previous five years of data.

Now that we created this table, we must analyze the data and determine what it indicates regarding the company’s ability to sustain a dividend distribution level or increase dividend payouts for your retirement income going forward. However, I will go over interpreting the data from the table above in my next article.

Bruce Miller is a certified financial planner (CFP) and retirement income expert who also is the author of Retirement Investing for INCOME ONLY: How to invest for reliable income in Retirement ONLY from Dividends and IRA Quick Reference Guide.