Following a fully fledged 10%-plus stock market correction, it’s my firm view that income investors should take a hard look at some well-managed closed-end funds that invest in big-capitalization technology stocks and write covered calls against their portfolios.

Volatility has returned to the market and that translates to the widening of option premiums in both puts and calls. There has been a lot of short-term technical damage done that will take months to sort out, but at the same time, the market is offering technology investors an excellent entry point in the best blue-chip tech stocks that offer attractive option income opportunities.

The tech sector has the least amount of risk associated with geopolitical issues, commodity price swings, sweeping government policy changes, consumer seasonality, political party affiliation, weather and Fed policy. The tech sector is also where the most attention is paid by the business media, and for good reason.

There is transformational change occurring in an array of industries through technological advances that fall into several categories. They include cloud computing, big data, mobile e-commerce, digital payments, 5G wireless, Internet of Things (IoT), autonomous vehicles, artificial intelligence (AI), virtual reality (VR), augmented reality (AR), robotics and machine learning.

Information Technology (IT) spending is rising. Business spending on IT is at the highest level since 2011. Technology shares have a good history of appreciating when rates rise. Flexible pricing power is bullish for active covered-call and naked put strategies on the best-of-breed tech stocks. So, let’s take a look at two closed-end funds that are trading well off their 52-week highs and that serve the purpose of casting a net over the big-cap technology sector while locking in current yields of greater than 6.0%.

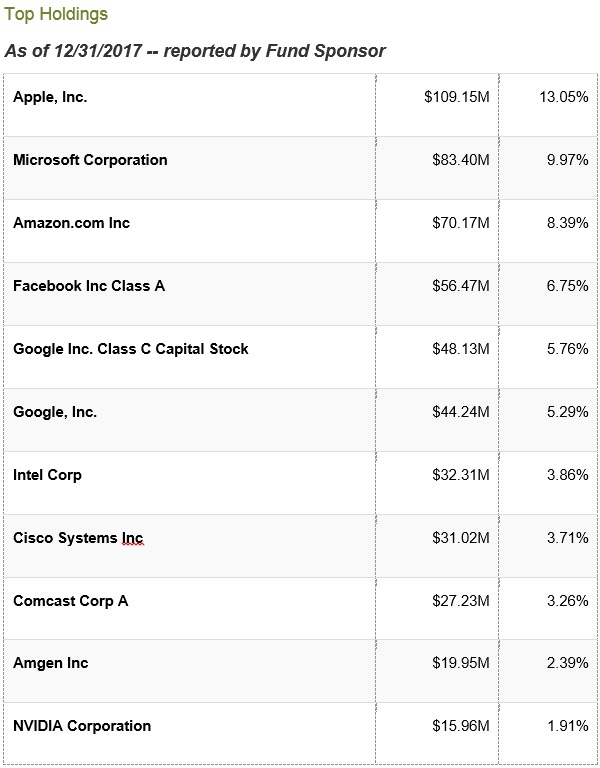

Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) — Yield 6.62%

Eaton Vance Enhanced Equity Income II (EOS) — Yield 6.43%

Earnings from the likes of Microsoft, Amazon, Adobe Systems, NVIDIA, Facebook and Intel were outstanding and 2018 should be another banner year for tech sector performance, even if interest rates edge higher. Hundreds of billions of dollars are getting budgeted by companies to invest in the many transformational technologies noted above. One could say the tech sector is leading America into another industrial revolution by way of advanced automation that brings efficiencies to both businesses and consumers at all levels.

The market is transitioning to an earnings-driven phase from a Fed stimulus phase and the transition, though bumpy, will smooth out with the tech sector leading the market to more new highs. While the market is searching for a bottom, it is prime time for those with cash on the sidelines to consider profiting from high-tech income.

It is rare to see the best-of-breed stocks that rule the NASDAQ trade at such a steep discount, but Christmas came early this year. Both the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) and the Eaton Vance Enhanced Equity Income II (EOS) are core holdings in my Cash Machine high-yield investment newsletter. To learn about Cash Machine, click here. My current model portfolio is sporting a blended yield of 9.0% with many holdings paying monthly dividends. Everything that is categorized as a major market-moving event occurs in a shorter span of time today, and it’s my view this correction won’t last long either. Focus on what America does best and buy leading technology when it’s on sale. At the same time, get paid well while doing it.