In have explained in previous articles the main theoretical aspects and strategies of option spread trading but now it is time to put that newfound knowledge into practice.

Trading has many similarities with athletics, since both require that you perfect the basics and execute your game plan. Dealing with conditions on the athletic field or on the trading screen requires mental toughness.

More than anything, both require the ability to deal with occasional losses. However, in both disciplines, winners are the individuals and the teams that learn from analyzing those losses and improve the game plan for future engagements.

I happen to enjoy playing chess because it involves many of the same skills as trading. I have to analyze the chessboard and the market to find opportunities to advance my position. The market, or my chess challenger, is there to take my resources as quickly as possible. If I read the chessboard or the market correctly and plan how to advance in the market or on the board with the correct strategy, I increase dramatically my chances of winning.

The great chess masters and the great trading masters use checklists. Without a checklist, they risk missing small details and making avoidable mistakes, which can lead to major defeats. You and I call it a loss, or getting crushed by the market. Whatever it is called, we want to avoid any blunders caused by ignoring the basics of sound trading practices.

Putting All the Tools Together

This section will give you a trading checklist to put together all the potential strategies. You might already be comfortable with the basics of analysis, as well as selecting sectors and picking specific options. While you might be ready to jump right into trading, I recommend that you hold off and go through a few trades with me. There are always gray areas when it comes to reading the market.

I am going to use the example of trading the Dow Jones Industrial Average (DJIA) index. I like this index. It is composed of 30 of the largest industrial-oriented companies and has some nice trend characteristics. Specifically, the Dow Jones Industrial Average index has lower volatility than trading commodity indexes, smaller capitalization stocks and certainly less than individual commodities.

You can choose almost any security in virtually any market that offers options. The one qualification is that you must be able to get enough data from graphs, charts, volumes and up-to-date quotes to evaluate the technical details necessary for creating a trade.

Analysis First

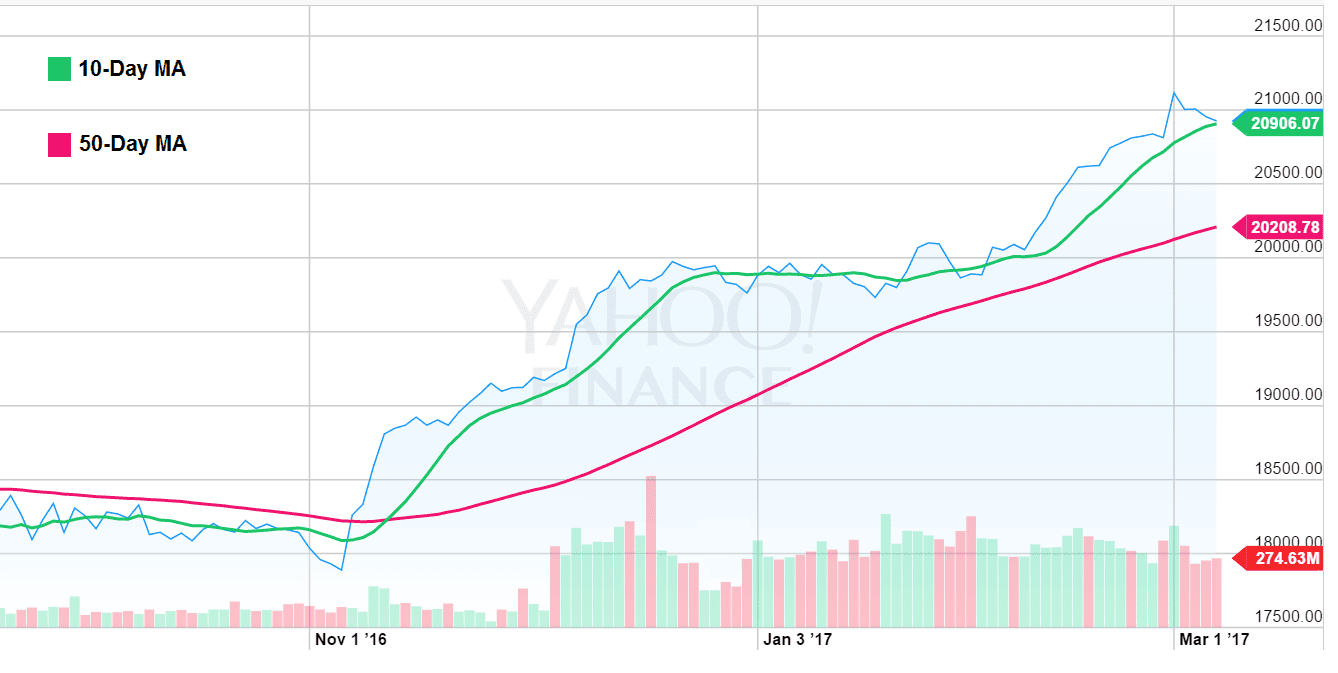

Dow Jones Industrial Average (DJIA): Source: Yahoo! Finance

The chart above shows the Dow Jones Industrial Average for the past six months. I chose a six-month timeframe because I wanted this example to focus on an options trade expiring within 30 to 60 days. With that short timeframe in mind, I was able to focus on a six-month timeframe for the chart rather than a year, two years or five years. It is quite possible to have a counter-trend rally that goes on for as long as six months or more in a bear market. This is probably not the case here, as there has been a general uptrend for multiple years, so I will not analyze it on a counter-trend basis.

The basic chart shows a steady movement from approximately 18,250 up to 21,000 over the past six months. The green line that is moving approximately along the peaks and valleys of the main Dow shaded chart is the 10-day moving average (MA). The other line that indicates a steady movement along the general trend of the Dow chart is the red 50-day moving average line . The chart shows the 10-day moving average to determine whether the average was in danger of crossing through the major 50-day trend. With the Dow Jones Industrial Average comfortably above both moving averages and showing bullish movement over the entire chart as explained with the climb from 18,250 to 21,000, I have full confirmation that the major trend and the current minor trend are bullish.

Potential trend reversals

I could analyze the chart further to determine whether there is a reversal point coming. However, this is unnecessary is because the short-term trend (10-day) and the longer-term trends (50-day) are in the same direction with no reversal already beginning. As I indicated in a previous article, calling reversals is challenging and gives away the main advantage of trend following and trend-direction trading.

I have established that the trend is bullish and that both short- and longer-term trend lines are confirming the overall movement of the index. Therefore, I will select a bullish-oriented option spread trading strategy. I could select a more neutral trading strategy with a bullish tilt, but I will go with the bullish-oriented strategy to keep this example simple.

In the next article, I will choose the direction that I want to trade, as well as my strategy, the timeframe and the trading vehicle.

Billy Williams is a 25-year veteran trader and author. For a free strategy guide, “Fundamentals for the Aspiring Trader”, and to learn more about profitable trading, go to www.stockoptionsystem.com.